📊 Gold 8th January 2025 Daily Analysis Based on Main Key Levels

- Neom

- Jan 8

- 2 min read

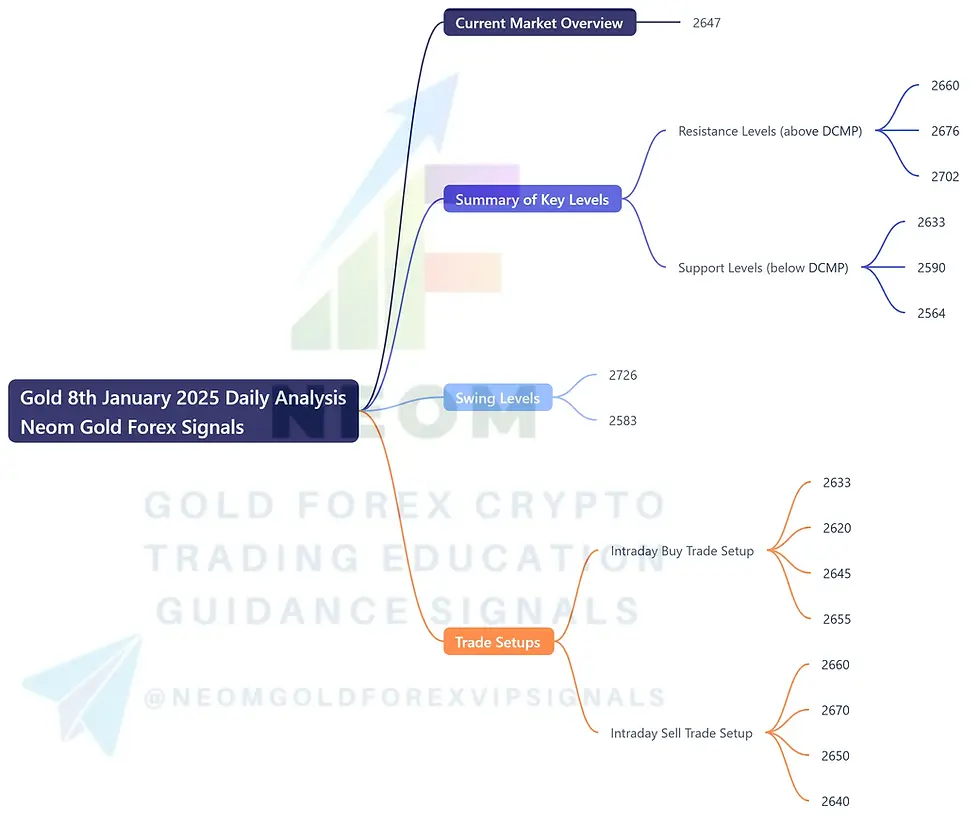

In the intricate landscape of gold trading, understanding key levels is essential for making informed decisions. This analysis focuses on gold, providing insights into resistance and support levels, trade setups, and crucial technical indicators.

📊 Current Market Overview

Daily Current Market Price (DCMP): 2647

🔍 Summary of Key Levels

Resistance Levels (above DCMP):

🔴 Resistance 1: 2660

🔴 Resistance 2: 2676

🔴 Resistance 3: 2702

Support Levels (below DCMP):

🟢 Support 1: 2633

🟢 Support 2: 2590

🟢 Support 3: 2564

📈 Swing Levels

Swing High: 2726

Swing Low: 2583

Technical Analysis

The current market price at 2647 is situated between significant resistance and support levels. Any key level above the DCMP functions as resistance, while levels below serve as support. Utilizing Fibonacci retracement and extension levels allows traders to identify potential reversal points.

💹 Trade Setups

🟢 Intraday Buy Trade Setup

📍 Entry Price: 2633

🛡️ Stop Loss: 2620

🎯 Take Profit 1: 2645

💰 Take Profit 2: 2655

This setup targets the support level, indicating a potential upward movement based on the current market structure.

🔴 Intraday Sell Trade Setup

📍 Entry Price: 2660

🛡️ Stop Loss: 2670

🎯 Take Profit 1: 2650

💰 Take Profit 2: 2640

This setup focuses on the resistance level, suggesting a potential downward movement.

Additional Technical Insights

Fibonacci Levels: Key Fibonacci retracement and extension levels align closely with resistance and support zones, providing additional validation for trade setups.

RSI Divergence: Monitoring RSI divergence is essential for identifying overbought or oversold conditions, aiding in timing entries and exits.

MACD Crossing: A MACD crossover could signal potential momentum shifts, reinforcing the trade ideas presented.

Conclusion

Understanding the key levels and market structure is vital for effective trading in gold. The outlined trade setups offer structured opportunities based on technical analysis, empowering traders to make informed decisions. By integrating these insights into your trading strategy, you can navigate the gold market with confidence.

Comments