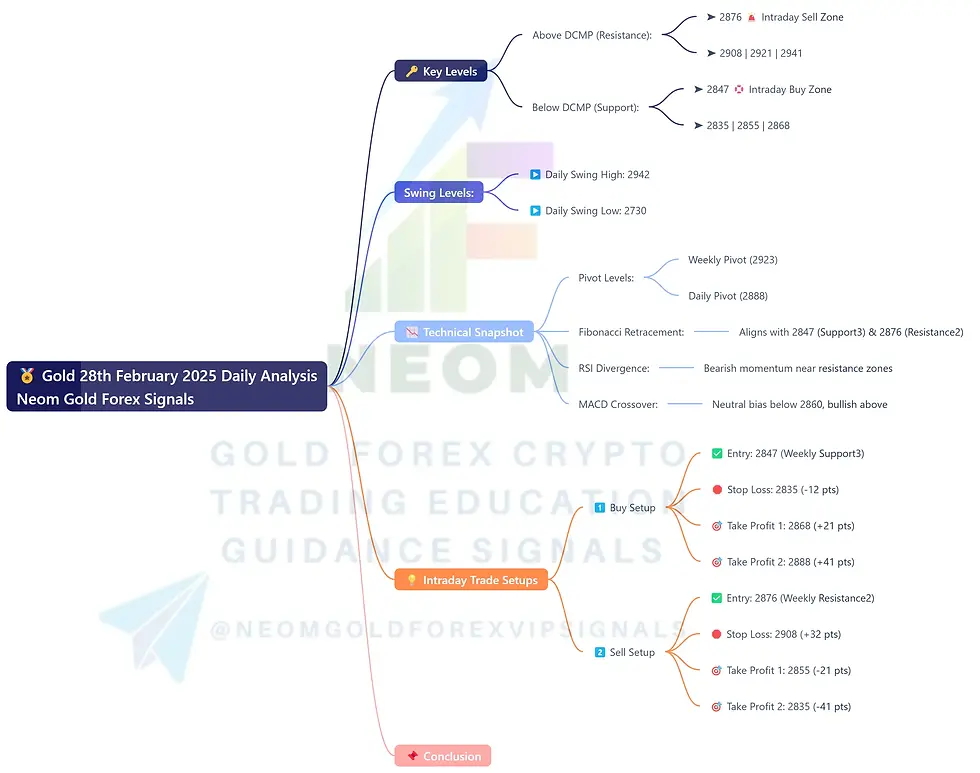

🏆 Gold 28th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 28

- 1 min read

Daily Current Market Price (DCMP): 🏷️ 2860

🔑 Key Levels

Above DCMP (Resistance):

➤ 2876 🚨 Intraday Sell Zone

➤ 2908 | 2921 | 2941

Below DCMP (Support):

➤ 2847 🛟 Intraday Buy Zone

➤ 2835 | 2855 | 2868

Swing Levels:

▶ Daily Swing High: 2942

▶ Daily Swing Low: 2730

📉 Technical Snapshot

Pivot Levels: Weekly Pivot (2923), Daily Pivot (2888)

Fibonacci Retracement: Aligns with 2847 (Support3) & 2876 (Resistance2)

RSI Divergence: Bearish momentum near resistance zones

MACD Crossover: Neutral bias below 2860, bullish above

💡 Intraday Trade Setups

1️⃣ Buy Setup

✅ Entry: 2847 (Weekly Support3)

🛑 Stop Loss: 2835 (-12 pts)

🎯 Take Profit 1: 2868 (+21 pts)

🎯 Take Profit 2: 2888 (+41 pts)

Rationale: Strong confluence at 2847 (Fib 61.8% + Weekly Support3).

2️⃣ Sell Setup

✅ Entry: 2876 (Weekly Resistance2)

🛑 Stop Loss: 2908 (+32 pts)

🎯 Take Profit 1: 2855 (-21 pts)

🎯 Take Profit 2: 2835 (-41 pts)

Rationale: Resistance cluster at 2876 aligns with 4H bearish divergence.

📌 Conclusion

Gold faces stiff resistance above 2860 DCMP, with critical intraday trades at 2876 (sell) and 2847 (buy). Monitor MACD for trend confirmation and respect strict stop losses. 🏁

Comments