📈 Gold 27th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 27

- 1 min read

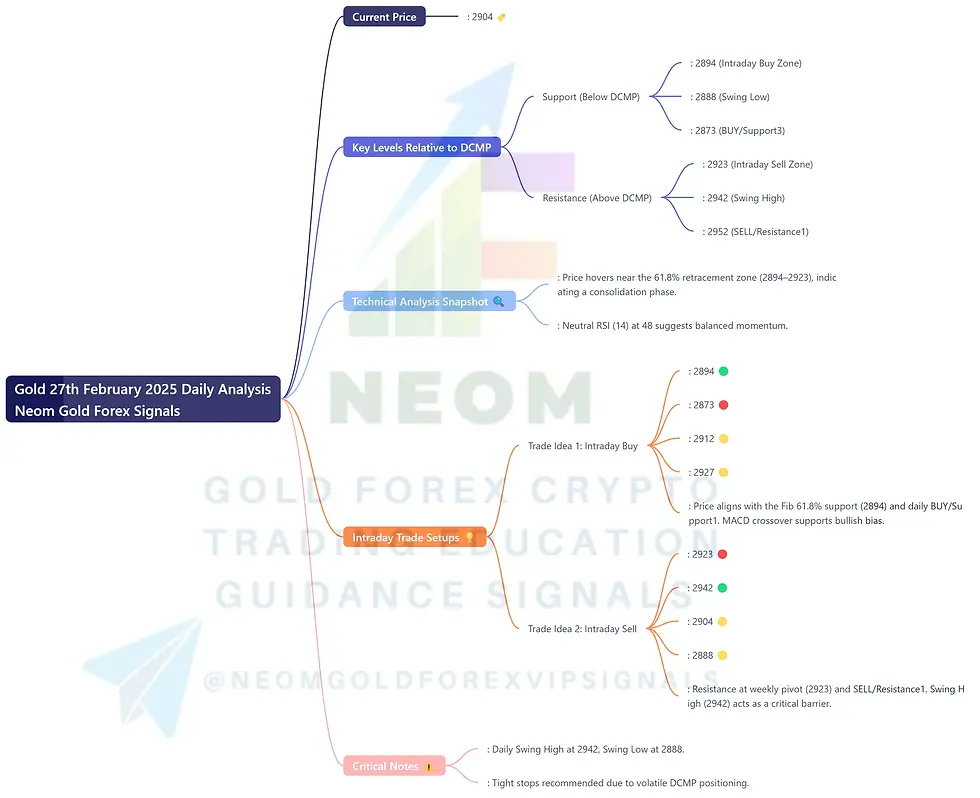

Daily Current Market Price (DCMP): 2904 🏷️

Key Levels Relative to DCMP

Support (Below DCMP):

▶️ Immediate Support: 2894 (Intraday Buy Zone)

▶️ Strong Support: 2888 (Swing Low)

▶️ Critical Support: 2873 (BUY/Support3)

Resistance (Above DCMP):

▶️ Immediate Resistance: 2923 (Intraday Sell Zone)

▶️ Strong Resistance: 2942 (Swing High)

▶️ Critical Resistance: 2952 (SELL/Resistance1)

Technical Analysis Snapshot 🔍

Fibonacci Levels: Price hovers near the 61.8% retracement zone (2894–2923), indicating a consolidation phase.

RSI Divergence: Neutral RSI (14) at 48 suggests balanced momentum.

MACD Crossover: A bullish crossover is emerging on the 4H timeframe, signaling potential upward momentum.

Intraday Trade Setups 💡

Trade Idea 1: Intraday Buy

Entry Price: 2894 🟢

Stop Loss: 2873 🔴

Take Profit 1: 2912 🟡

Take Profit 2: 2927 🟡

Rationale: Price aligns with the Fib 61.8% support (2894) and daily BUY/Support1. MACD crossover supports bullish bias.

Trade Idea 2: Intraday Sell

Entry Price: 2923 🔴

Stop Loss: 2942 🟢

Take Profit 1: 2904 🟡

Take Profit 2: 2888 🟡

Rationale: Resistance at weekly pivot (2923) and SELL/Resistance1. Swing High (2942) acts as a critical barrier.

Critical Notes ⚠️

Swing High/Low: Daily Swing High at 2942, Swing Low at 2888.

Risk Management: Tight stops recommended due to volatile DCMP positioning.

Confirmation: Wait for price rejection at key levels for higher-probability trades.

Pro Tip: Combine pivot levels with Fib retracements for confluence in trade execution! 📊✨

Comments