📈 Gold 18th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 18

- 1 min read

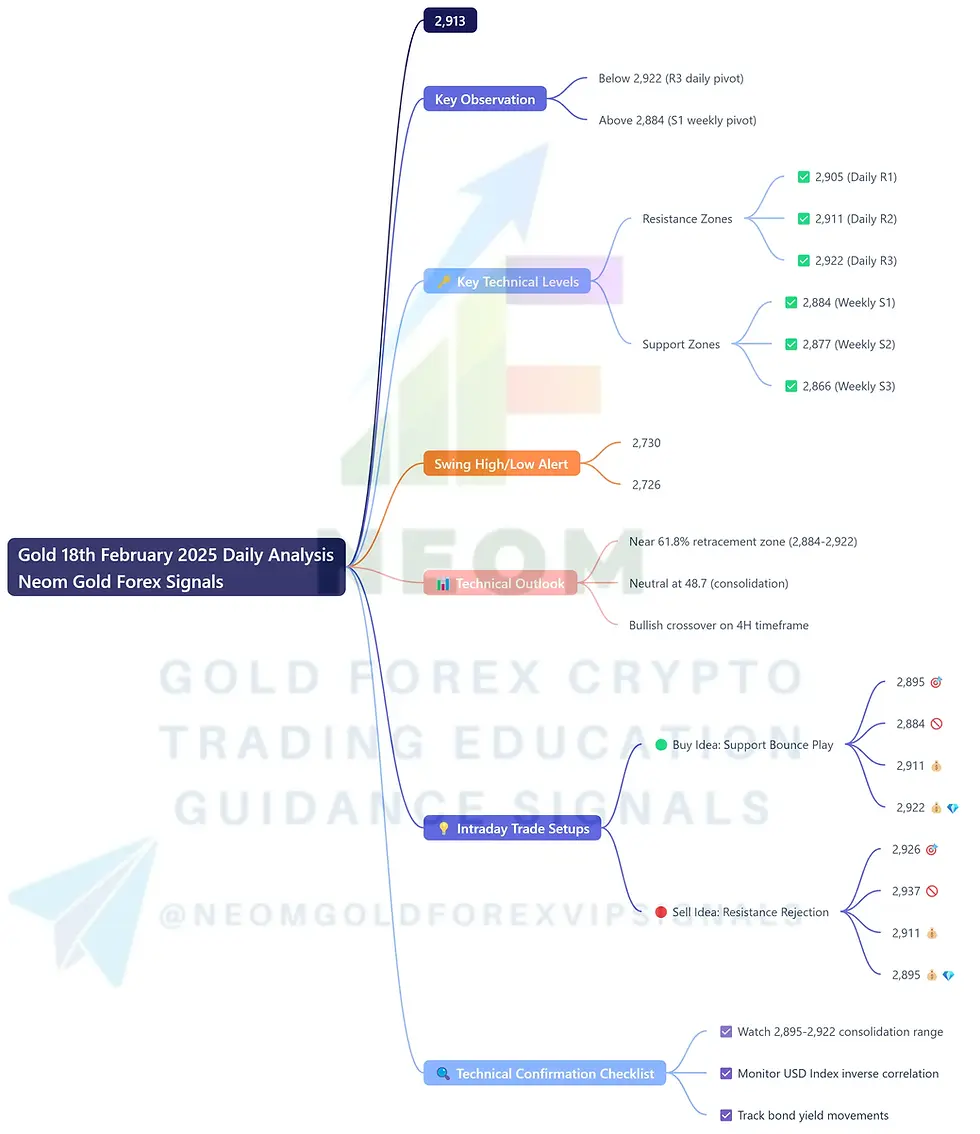

Daily Current Market Price (DCMP): 2,913

Key Observation: Gold trades below immediate resistance at 2,922 (R3 daily pivot) and above critical support at 2,884 (S1 weekly pivot).

🔑 Key Technical Levels

Resistance Zones

✅ 2,905 (Daily R1)

✅ 2,911 (Daily R2)

✅ 2,922 (Daily R3)

Support Zones

✅ 2,884 (Weekly S1)

✅ 2,877 (Weekly S2)

✅ 2,866 (Weekly S3)

Swing High/Low Alert: Daily swing high at 2,730 and swing low at 2,726 (monitor for trend confirmation).

📊 Technical Outlook

Fibonacci: Price hovers near 61.8% retracement zone between 2,884-2,922

RSI Divergence: Neutral at 48.7 signals consolidation

MACD: Bullish crossover emerging on 4H timeframe

💡 Intraday Trade Setups

🟢 Buy Idea: Support Bounce Play

Entry: 2,895 🎯

Stop Loss: 2,884 🚫

Take Profit 1: 2,911 💰 (Daily R2)

Take Profit 2: 2,922 💰💎 (Daily R3)

🔴 Sell Idea: Resistance Rejection

Entry: 2,926 🎯

Stop Loss: 2,937 🚫

Take Profit 1: 2,911 💰 (Daily R2)

Take Profit 2: 2,895 💰💎 (Weekly Pivot)

🧠 Smart Trader Tip

"Price shows compression between daily/weekly pivots - wait for confirmed breakout with volume surge before committing capital. Risk-reward ratio favors long positions below DCMP with tight stops."

🔍 Technical Confirmation Checklist

☑️ Watch 2,895-2,922 consolidation range

☑️ Monitor USD Index inverse correlation

☑️ Track bond yield movements

Comments