📈 Gold 10th February 2025 Daily Trading Analysis: Key Levels & Trade Opportunities

- Neom

- Feb 10

- 1 min read

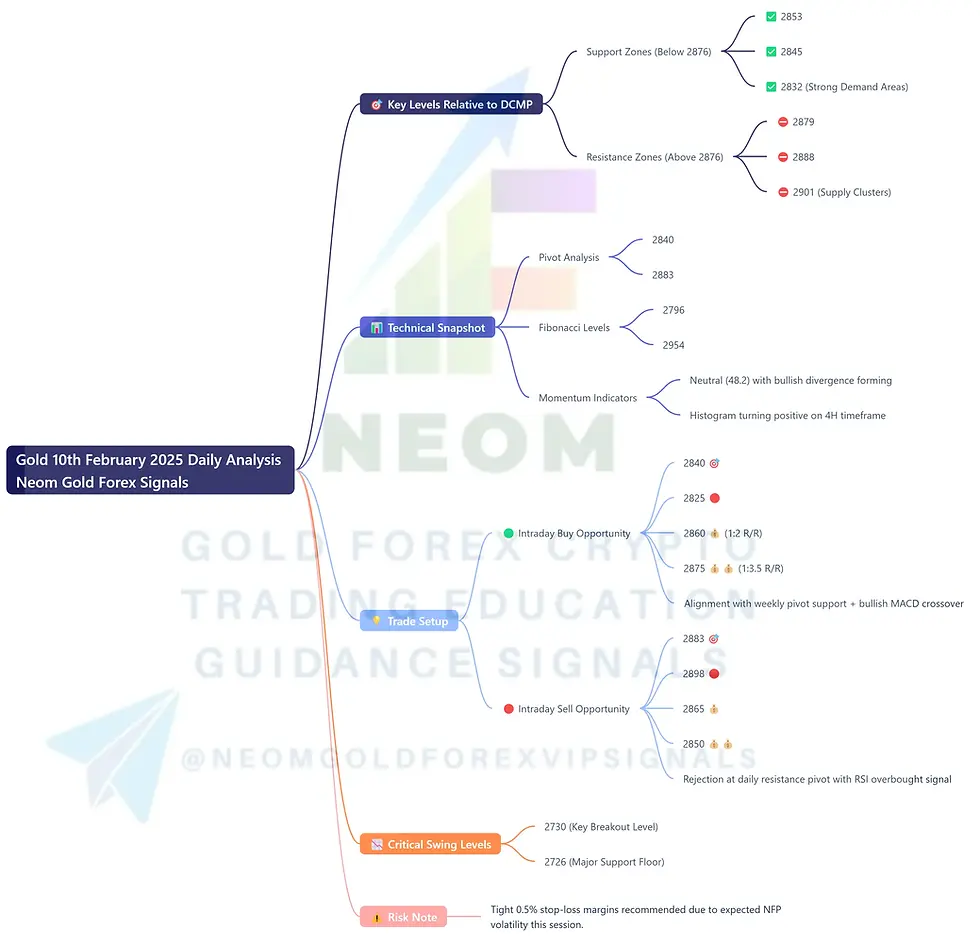

Daily Current Market Price (DCMP): 2876

🎯 Key Levels Relative to DCMP

Support Zones (Below 2876):

✅ 2853 | 2845 | 2832 (Strong Demand Areas)

Resistance Zones (Above 2876):

⛔️ 2879 | 2888 | 2901 (Supply Clusters)

📊 Technical Snapshot

Pivot Analysis:

Critical Support Pivot: 2840

Immediate Resistance Pivot: 2883

Fibonacci Levels:

61.8% Retracement Anchor: 2796

127% Extension Zone: 2954

Momentum Indicators:

RSI: Neutral (48.2) with bullish divergence forming

MACD: Histogram turning positive on 4H timeframe

💡 Trade Setup

🟢 Intraday Buy Opportunity

Entry Price: 2840 🎯

Stop Loss: 2825 🔴

Take Profit 1: 2860 💰 (1:2 R/R)

Take Profit 2: 2875 💰💰 (1:3.5 R/R)

Rationale: Alignment with weekly pivot support + bullish MACD crossover

🔴 Intraday Sell Opportunity

Entry Price: 2883 🎯

Stop Loss: 2898 🔴

Take Profit 1: 2865 💰

Take Profit 2: 2850 💰💰

Trigger: Rejection at daily resistance pivot with RSI overbought signal

📉 Critical Swing Levels

Swing High: 2730 (Key Breakout Level)

Swing Low: 2726 (Major Support Floor)

💬 Analyst Insight

Gold shows tight consolidation between 2840-2883 pivots. The 2876 DCMP acts as immediate equilibrium - sustained break above 2888 needed for bullish confirmation, while slip below 2845 could trigger stop-loss cascade. Monitor US Dollar index correlations for fundamental confirmation of technical setups.

⚠️ Risk Note: Tight 0.5% stop-loss margins recommended due to expected NFP volatility this session.

Comments