🟡 XAUUSD Daily Market Analysis—May 23, 2025

- Neom

- May 23, 2025

- 3 min read

Introduction

Gold (XAUUSD) has always been a safe-haven asset, especially during times of economic uncertainty. As of today, the live market price for gold stands at $3,314 USD. In this analysis, we will delve into the daily and 4-hour time frames, utilizing various technical indicators including Fibonacci Retracement Levels, Exponential Moving Averages (EMA), RSI divergence, Weekly and Daily Pivots, Smart Money Concepts (SMC), Support & Resistance Levels, Order Blocks, and the MACD indicator. This comprehensive overview aims to provide traders with insights into potential price movements and strategies.

Market Analysis

Current Market Overview

At the current price of $3,314, gold is positioned between recent swing high and low levels. The swing high is noted at $3,438, while the swing low is at $3,120. Understanding these levels is crucial for traders looking to identify potential entry and exit points.

Support & Resistance Levels

Daily Time Frame

Support Levels:

$3,200

$3,250

$3,280

Resistance Levels:

$3,350

$3,400

$3,450

4-Hour Time Frame

Support Levels:

$3,280

$3,300

$3,250

Resistance Levels:

$3,350

$3,380

$3,400

These support and resistance levels are critical for understanding potential price action. Traders often look for price reactions at these levels to make informed decisions.

Fibonacci Retracement Levels

Using the recent swing high and low, we can identify the Fibonacci retracement levels:

23.6% Level: $3,250

38.2% Level: $3,180

50% Level: $3,175

61.8% Level: $3,100

These levels provide insight into potential reversal points in the market, helping traders to set targets and stop-loss orders effectively.

Exponential Moving Averages (EMA)

Daily Time Frame

EMA 50: $3,280

EMA 100: $3,250

EMA 200: $3,200

EMA 400: $3,180

4-Hour Time Frame

EMA 50: $3,300

EMA 100: $3,290

EMA 200: $3,270

EMA 400: $3,250

The EMAs are essential indicators for identifying trends. A price above the EMA lines suggests a bullish trend, while a price below indicates a bearish trend.

RSI Divergence

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Currently, if we observe divergence between price and RSI, it could indicate a potential reversal or continuation of the trend. For example, if prices are making new highs while RSI is making lower highs, this could signal a bearish divergence.

Order Blocks

Order blocks represent areas where significant buying or selling occurred. Identifying these blocks can provide traders with insight into potential support and resistance zones. In the current market, key order blocks can be observed around the support and resistance levels mentioned earlier.

MACD Analysis

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders should look for crossovers and divergences in the MACD to confirm potential entry or exit points.

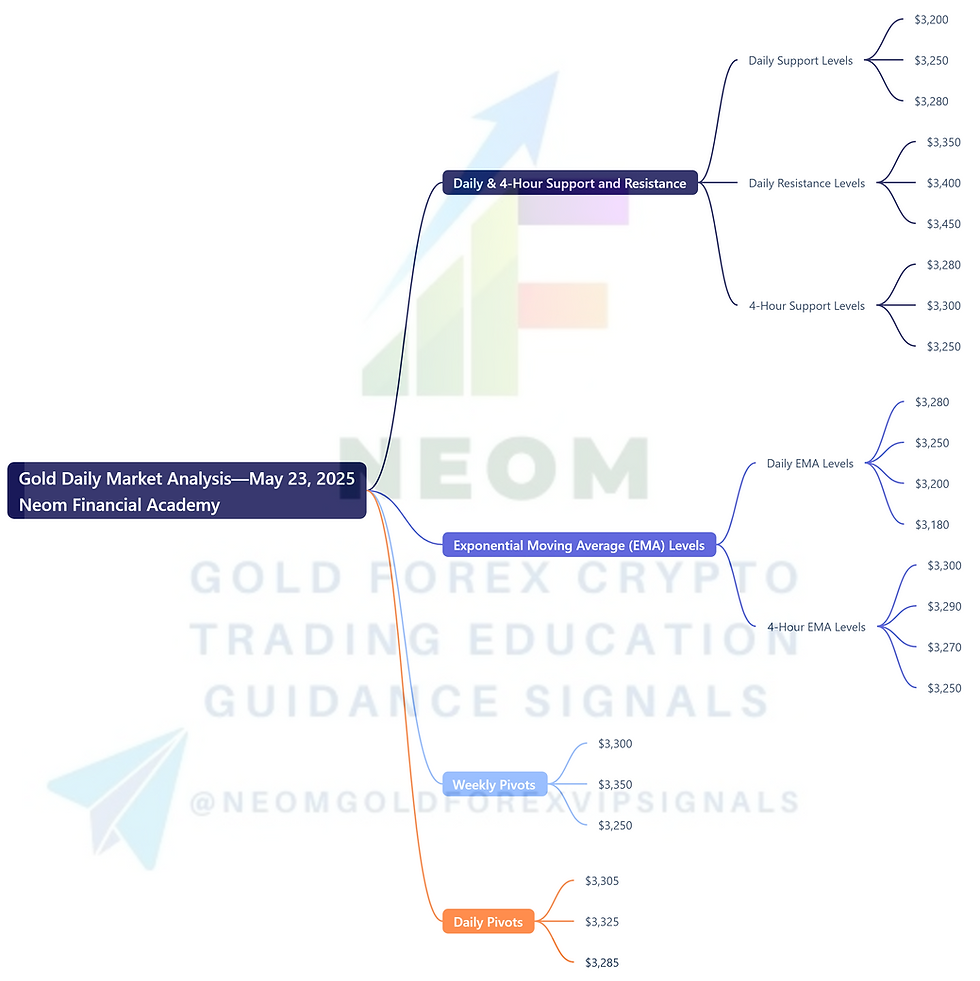

Summary of Key Levels

Daily & 4-Hour Support and Resistance

Daily Support Levels: $3,200, $3,250, $3,280

Daily Resistance Levels: $3,350, $3,400, $3,450

4-Hour Support Levels: $3,280, $3,300, $3,250

4-Hour Resistance Levels: $3,350, $3,380, $3,400

Exponential Moving Average (EMA) Levels

Daily EMA Levels:

EMA 50: $3,280

EMA 100: $3,250

EMA 200: $3,200

EMA 400: $3,180

4-Hour EMA Levels:

EMA 50: $3,300

EMA 100: $3,290

EMA 200: $3,270

EMA 400: $3,250

Weekly Pivots

Pivot Point: $3,300

Resistance 1: $3,350

Support 1: $3,250

Daily Pivots

Pivot Point: $3,305

Resistance 1: $3,325

Support 1: $3,285

Fibonacci Retracement Levels

23.6% Level: $3,250

38.2% Level: $3,180

50% Level: $3,175

61.8% Level: $3,100

Fundamental Analysis and Upcoming USD News

As we analyze the gold market, it’s crucial to consider the fundamental factors influencing price movements. The upcoming economic data releases concerning the USD can significantly impact gold prices. Key upcoming events include:

Federal Reserve Meetings: Decisions regarding interest rates can lead to fluctuations in gold prices, as higher interest rates typically strengthen the dollar and weaken gold.

Inflation Reports: Higher inflation can lead to increased demand for gold as a hedge, impacting its price positively.

Employment Data: Strong employment figures may lead to a stronger dollar, which could negatively affect gold prices.

Traders should keep an eye on these events as they can create volatility in the market, influencing both short-term and long-term trading decisions.

Conclusion

In conclusion, the current analysis of XAUUSD reveals critical support and resistance levels, along with significant indicators such as EMAs, Fibonacci levels, RSI divergence, and MACD. Understanding these elements can aid traders in making informed decisions. As the market continues to evolve, staying updated on both technical and fundamental factors will be essential for successful trading strategies in the gold market.

Comments