🟡 XAUUSD Daily Market Analysis—August 1, 2025

- Neom

- Aug 1, 2025

- 3 min read

Introduction

In today's analysis, we delve into the XAUUSD market, currently trading at 3294 USD. This comprehensive report will explore the daily and 4-hour time frames using various technical indicators, including Fibonacci Retracement Levels, Exponential Moving Averages (EMA), RSI divergence, and more. We aim to provide a detailed market overview, highlighting key support and resistance levels, pivot points, and potential trading strategies.

Market Analysis Overview

Current Market Price

XAUUSD Live Price: 3294 USD

Swing Levels

Swing High: 3438

Swing Low: 3268

Technical Indicators

Support and Resistance Levels

Daily Time Frame

Support Levels:

Level 1: 3268 (Swing Low)

Level 2: 3250

Level 3: 3230

Resistance Levels:

Level 1: 3438 (Swing High)

Level 2: 3400

Level 3: 3350

4-Hour Time Frame

Support Levels:

Level 1: 3280

Level 2: 3260

Level 3: 3250

Resistance Levels:

Level 1: 3310

Level 2: 3350

Level 3: 3375

Fibonacci Retracement Levels

Using the swing high of 3438 and swing low of 3268, we can identify the following Fibonacci levels:

23.6% Level: 3310

38.2% Level: 3300

50% Level: 3290

61.8% Level: 3280

Exponential Moving Averages (EMA)

Daily Time Frame

EMA 50: 3310

EMA 100: 3285

EMA 200: 3270

EMA 400: 3255

4-Hour Time Frame

EMA 50: 3295

EMA 100: 3282

EMA 200: 3275

EMA 400: 3260

RSI Divergence

The Relative Strength Index (RSI) indicates a divergence pattern on the daily chart, suggesting potential reversal points. Currently, the RSI is at 55, indicating a neutral position, but the divergence suggests caution for bullish momentum.

Order Blocks

Order blocks are identified around the key support and resistance levels. The order block around 3300 has shown significant buying interest, while the area near 3400 has been a strong selling zone.

MACD Analysis

The MACD indicator shows a bullish crossover on the daily chart, suggesting upward momentum. The histogram is positive, indicating that buyers are gaining strength, but traders should monitor for any signs of reversal.

Summary of Key Levels

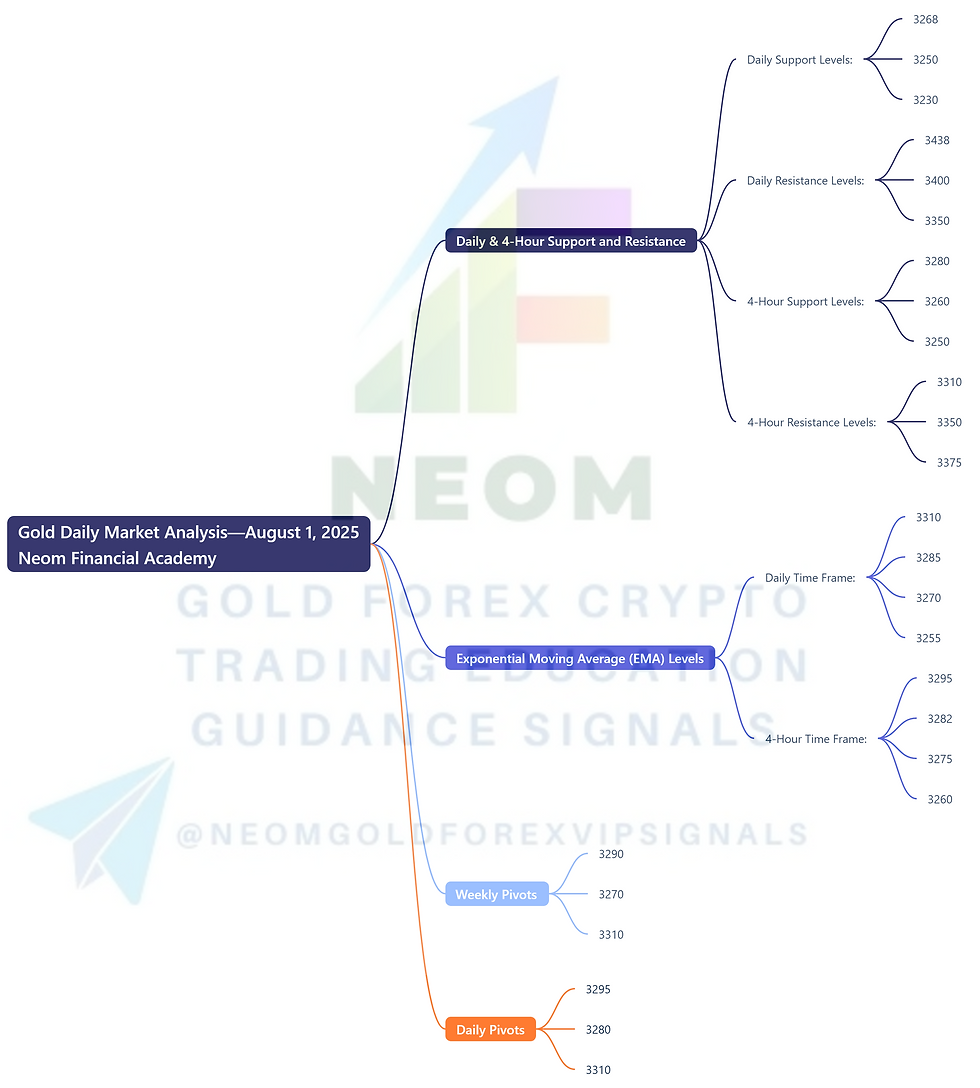

Daily & 4-Hour Support and Resistance

Daily Support Levels: 3268, 3250, 3230

Daily Resistance Levels: 3438, 3400, 3350

4-Hour Support Levels: 3280, 3260, 3250

4-Hour Resistance Levels: 3310, 3350, 3375

Exponential Moving Average (EMA) Levels

Daily Time Frame

EMA 50: 3310

EMA 100: 3285

EMA 200: 3270

EMA 400: 3255

4-Hour Time Frame

EMA 50: 3295

EMA 100: 3282

EMA 200: 3275

EMA 400: 3260

Weekly Pivots

Pivot Point: 3290

Support 1: 3270

Resistance 1: 3310

Daily Pivots

Pivot Point: 3295

Support 1: 3280

Resistance 1: 3310

Fibonacci Retracement Levels

23.6% Level: 3310

38.2% Level: 3300

50% Level: 3290

Fundamental Analysis and Upcoming USD News

As we look ahead, several key economic events affecting the USD could impact the XAUUSD market:

Non-Farm Payrolls (NFP): Scheduled for August 4, 2025. This report will provide insights into job growth and could influence USD strength.

Consumer Price Index (CPI): Expected release on August 10, 2025. This inflation measure will be crucial for assessing the Fed's monetary policy stance.

Federal Reserve Meeting: Scheduled for August 15, 2025. Any changes in interest rates will directly affect gold prices.

These upcoming events are essential for traders to monitor, as they can lead to increased volatility in the XAUUSD market.

Conclusion

In summary, the XAUUSD market presents a complex but intriguing landscape for traders. With current support and resistance levels established, combined with key technical indicators such as EMAs, Fibonacci levels, and MACD analysis, traders are well-equipped to navigate this market. As we approach critical economic events, maintaining awareness of fundamental factors will be vital for making informed trading decisions.

Comments