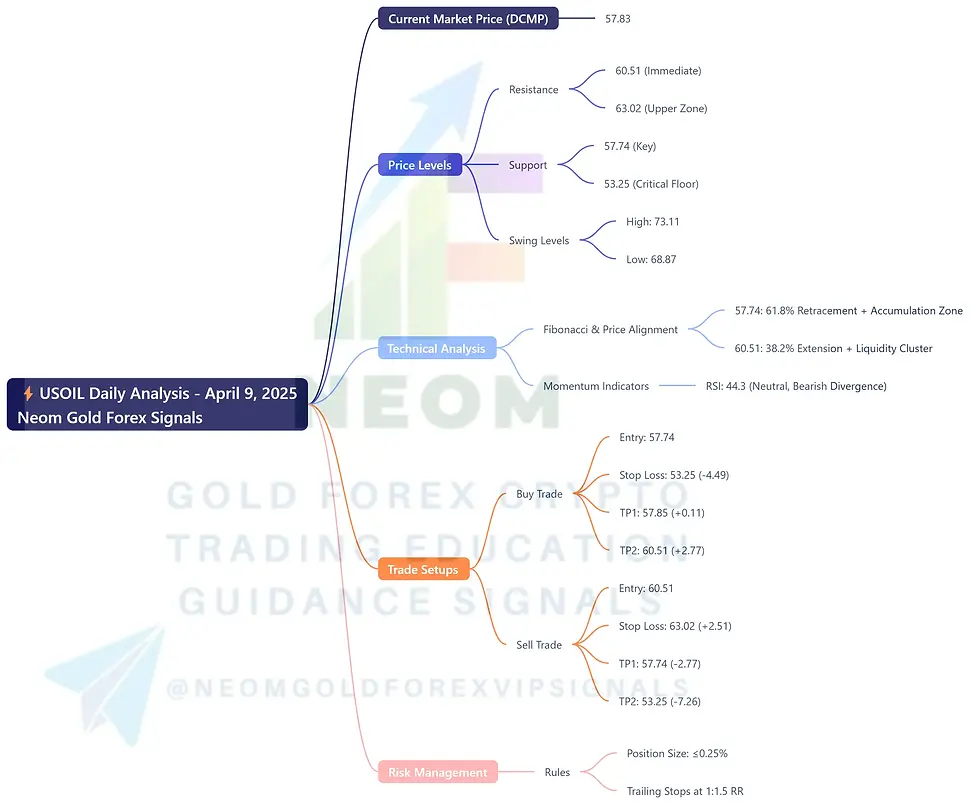

⚡USOIL Daily Analysis Based on Main Key Levels - April 9, 2025

- Neom

- Apr 9

- 1 min read

Daily Current Market Price (DCMP): 57.83 🔍

Critical Price Framework 🔥

Above DCMP (Resistance)

60.51 🟥 (Immediate Resistance)

63.02 ⚠️ (Upper Resistance Zone)

Below DCMP (Support)

57.74 🟩 (Key Support)

53.25 🛑 (Critical Floor)

Swing Levels

Swing High: 73.11

Swing Low: 68.87

Technical Confluence 🔍

Fibonacci & Price Alignment

57.74 Support: 61.8% Fib retracement of Q1 2025 downtrend + Institutional accumulation zone

60.51 Resistance: 38.2% Fib extension + Short-term liquidity cluster

Momentum Indicators

RSI: 44.3 (Neutral with bearish divergence on 4H chart)

MACD: Bearish histogram expansion on daily timeframe

Intraday Trade Setups ⚡

🟢 Intraday Buy Trade Idea

Entry: 57.74 🟩 (Strong Support Zone)

Stop Loss: 53.25 🛑 (-4.49 pips)

Take Profit 1: 57.85 🎯 (+0.11 pips)

Take Profit 2: 60.51 🚀 (+2.77 pips)

Rationale: Confluence of Fib support and bullish order block alignment.

🔴 Intraday Sell Trade Idea

Entry: 60.51 🟥 (Key Resistance Cluster)

Stop Loss: 63.02 ⚠️ (+2.51 pips)

Take Profit 1: 57.74 📉 (-2.77 pips)

Take Profit 2: 53.25 🛑 (-7.26 pips)

Rationale: Price rejection at Fib extension + bearish liquidity grab pattern.

Key Technical Drivers 🛠️

Resistance Band: 60.51–63.02 (Fib extension + options expiry gamma zone)

Support Zone: 57.74–53.25 (OPEC price defense threshold)

Catalyst: EIA crude inventory data (10:30 AM EST)

Risk Management Protocol ⚠️

Position sizing ≤0.25% per trade (volatility-adjusted)

Trailing stops activated at 1:1.5 risk-reward ratio

Avoid trading during API/EIA data release window

Comments