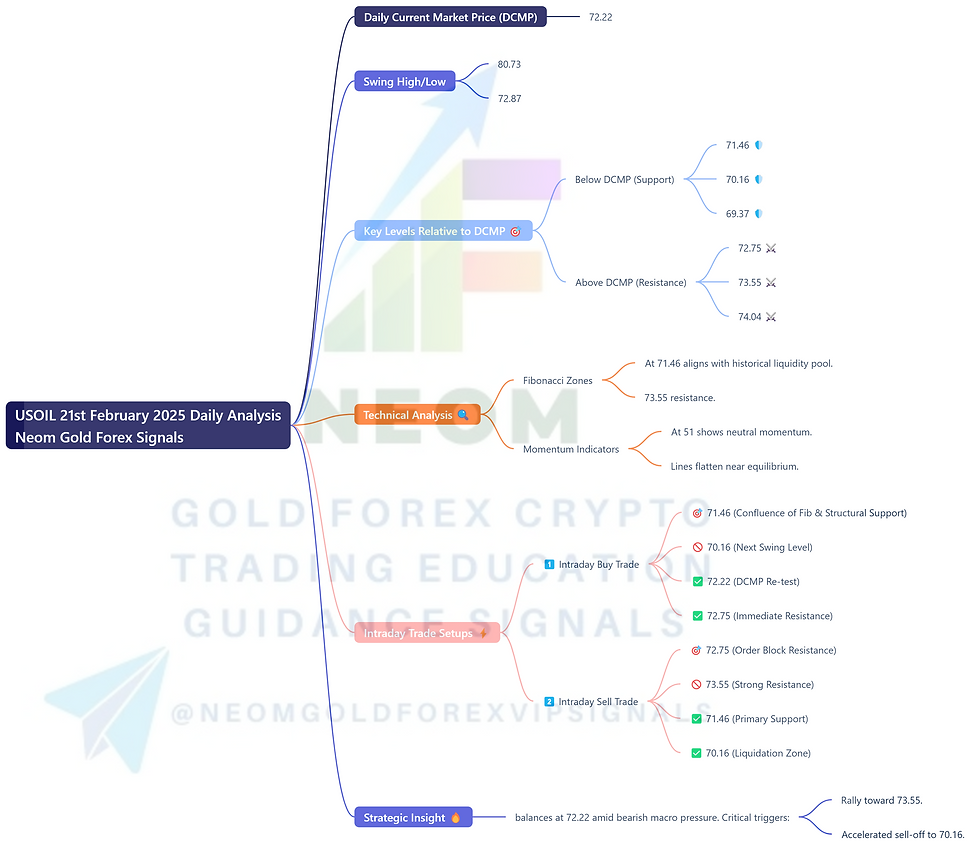

🛢️ USoil 21st February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 21

- 1 min read

Market Snapshot 📌

Daily Current Market Price (DCMP): 72.22

Swing High: 80.73 | Swing Low: 72.87

Key Levels Relative to DCMP 🎯

Below DCMP (Support):

Immediate Support: 71.46 🛡️

Strong Support: 70.16 🛡️

Critical Floor: 69.37 🛡️

Above DCMP (Resistance):

Immediate Resistance: 72.75 ⚔️

Strong Resistance: 73.55 ⚔️

Upper Barrier: 74.04 ⚔️

Technical Analysis 🔍

Fibonacci Zones:

38.2% retracement at 71.46 aligns with historical liquidity pool.

61.8% extension targets 73.55 resistance.

Momentum Indicators:

RSI at 51 shows neutral momentum.

MACD lines flatten near equilibrium.

Intraday Trade Setups ⚡

1️⃣ Intraday Buy Trade

Entry: 🎯 71.46 (Confluence of Fib & Structural Support)

Stop Loss: 🚫 70.16 (Next Swing Level)

Take Profit 1: ✅ 72.22 (DCMP Re-test)

Take Profit 2: ✅ 72.75 (Immediate Resistance)

2️⃣ Intraday Sell Trade

Entry: 🎯 72.75 (Order Block Resistance)

Stop Loss: 🚫 73.55 (Strong Resistance)

Take Profit 1: ✅ 71.46 (Primary Support)

Take Profit 2: ✅ 70.16 (Liquidation Zone)

Strategic Insight 🔥

USOIL balances at 72.22 amid bearish macro pressure. Critical triggers:

Break & close above 72.75 → Rally toward 73.55.

Sustained drop below 71.46 → Accelerated sell-off to 70.16.

Execute trades with 1:3 risk-reward ratio. Validate entries with bullish/bearish rejection candles.

🔔 Pro Tip: Track inventory data releases – sudden volatility spikes often reverse at technical support/resistance clusters.

Comments