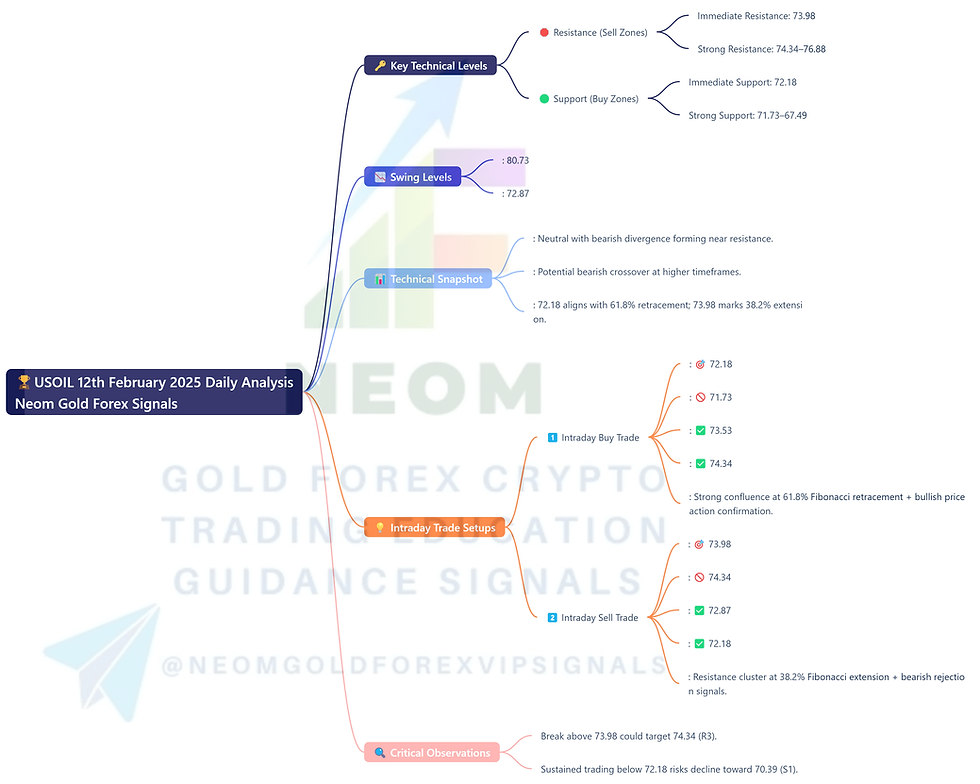

📊 USOIL 12th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 12

- 1 min read

Daily Current Market Price (DCMP): 72.99

Price consolidates above immediate support, with resistance dominance above DCMP. Critical swing levels define trend boundaries.

🔑 Key Technical Levels

🛑 Resistance (Sell Zones)

Immediate Resistance: 73.98

Strong Resistance: 74.34–76.88

🟢 Support (Buy Zones)

Immediate Support: 72.18

Strong Support: 71.73–67.49

📉 Swing Levels

Swing High: 80.73

Swing Low: 72.87

📊 Technical Snapshot

RSI: Neutral with bearish divergence forming near resistance.

MACD: Potential bearish crossover at higher timeframes.

Fibonacci: 72.18 aligns with 61.8% retracement; 73.98 marks 38.2% extension.

💡 Intraday Trade Setups

1️⃣ Intraday Buy Trade

Entry: 🎯 72.18

Stop Loss: 🚫 71.73

Take Profit 1: ✅ 73.53

Take Profit 2: ✅ 74.34

Rationale: Strong confluence at 61.8% Fibonacci retracement + bullish price action confirmation.

2️⃣ Intraday Sell Trade

Entry: 🎯 73.98

Stop Loss: 🚫 74.34

Take Profit 1: ✅ 72.87

Take Profit 2: ✅ 72.18

Rationale: Resistance cluster at 38.2% Fibonacci extension + bearish rejection signals.

🔍 Critical Observations

Break above 73.98 could target 74.34 (R3).

Sustained trading below 72.18 risks decline toward 70.39 (S1).

Watch for MACD crossover confirmation near key levels.

⚠️ Risk Note: Tight stops advised amid geopolitical supply risks and inventory data volatility.

Comments