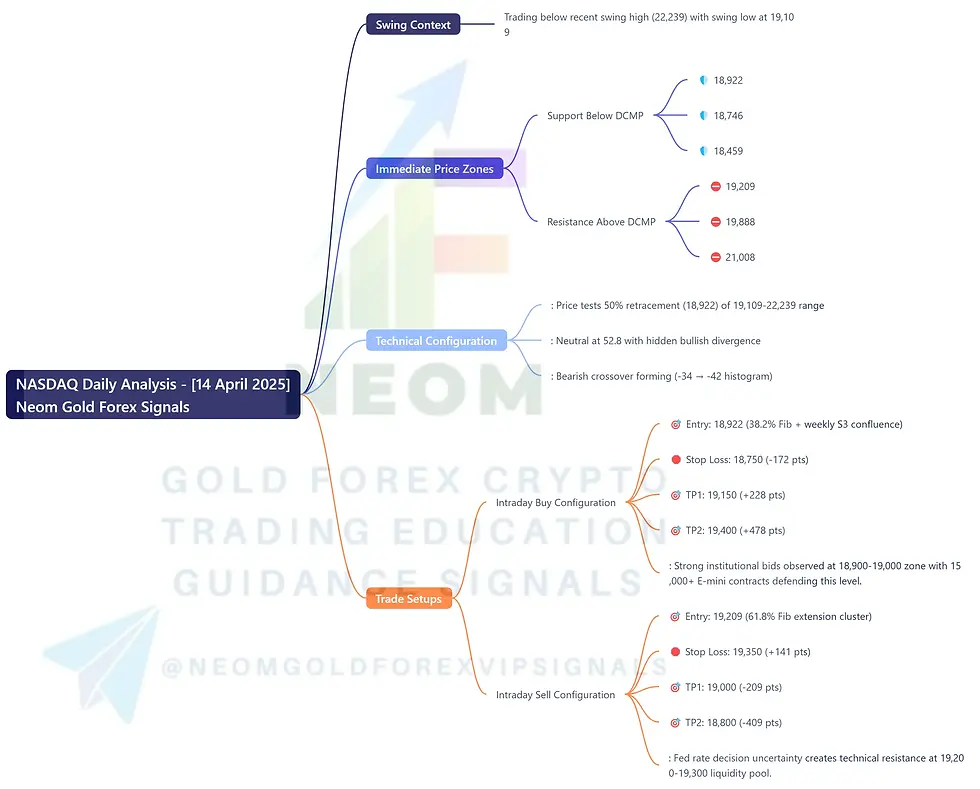

📉📈 NASDAQ Daily Analysis Based on Main Key Levels - [14 April 2025]

- Neom

- Apr 14, 2025

- 1 min read

Daily Current Market Price (DCMP): 19,010

Swing Context: Trading below recent swing high (22,239) with swing low at 19,109

🔑 Immediate Price Zones

Support Below DCMP:

🛡️ 18,922 | 18,746 | 18,459

Resistance Above DCMP:

⛔ 19,209 | 19,888 | 21,008

📊 Technical Configuration

• Fibonacci Framework: Price tests 50% retracement (18,922) of 19,109-22,239 range

• RSI Dynamics: Neutral at 52.8 with hidden bullish divergence

• MACD Signal: Bearish crossover forming (-34 → -42 histogram)

💼 Trade Setups

🟢 Intraday Buy Configuration

🎯 Entry: 18,922 (38.2% Fib + weekly S3 confluence)

🛑 Stop Loss: 18,750 (-172 pts)

🎯 TP1: 19,150 (+228 pts)

🎯 TP2: 19,400 (+478 pts)

Rationale: Strong institutional bids observed at 18,900-19,000 zone with 15,000+ E-mini contracts defending this level.

🔴 Intraday Sell Configuration

🎯 Entry: 19,209 (61.8% Fib extension cluster)

🛑 Stop Loss: 19,350 (+141 pts)

🎯 TP1: 19,000 (-209 pts)

🎯 TP2: 18,800 (-409 pts)

Rationale: Fed rate decision uncertainty creates technical resistance at 19,200-19,300 liquidity pool.

⚠️ Risk Management

Maintain 1:2.5 risk-reward ratio. Monitor NYSE TICK data for institutional flow confirmation.

Comments