🪙 Gold Daily Analysis Based on Main Key Levels – May 6, 2025

- Neom

- May 6, 2025

- 1 min read

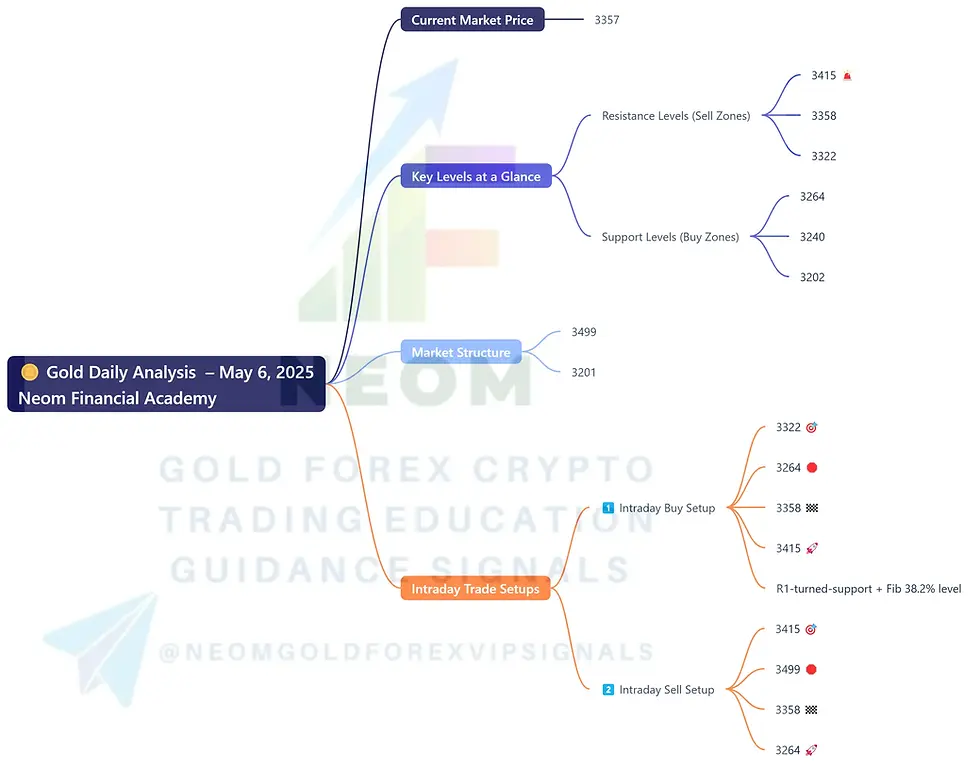

Daily Current Market Price (DCMP): 3357

Above DCMP: Resistance zones dominate

Below DCMP: Support zones in play

🔑 Key Levels at a Glance

Resistance Levels (Sell Zones):

R3: 3415 🚨

R2: 3358

R1: 3322

Support Levels (Buy Zones):

S1: 3264

S2: 3240

S3: 3202

Swing High (Daily): 3499 | Swing Low (Daily): 3201

📊 Technical Analysis Snapshot

RSI Divergence: Bullish momentum building near S1 (3264).

MACD: Potential bullish crossover at lower timeframes.

Fibonacci Levels:

61.8% retracement aligns with S2 (3240).

127% extension near R3 (3415).

💡 Intraday Trade Setups

1️⃣ Intraday Buy Setup

Entry: 🎯 3322

Stop Loss: 🛑 3264

Take Profit 1: 🏁 3358

Take Profit 2: 🚀 3415

Rationale: Price aligns with R1-turned-support and Fib 38.2% level.

2️⃣ Intraday Sell Setup

Entry: 🎯 3415

Stop Loss: 🛑 3499

Take Profit 1: 🏁 3358

Take Profit 2: 🚀 3264

Rationale: R3 coincides with 127% Fib extension and swing high confluence.

⚠️ Risk Management Tips

Use tight stops for intraday trades.

Trail profits aggressively above R2 (3358) or below S1 (3264).

📅 Final Thoughts

Gold faces critical resistance at 3358-3415, while 3264-3240 acts as a demand zone. Today’s DCMP (3357) creates a neutral bias, but a break above R2 or below S1 will dictate trend direction.

Comments