🎯 GBPJPY 31st January 2025 Daily Analysis Based on Main Key Levels

- Neom

- Jan 31

- 2 min read

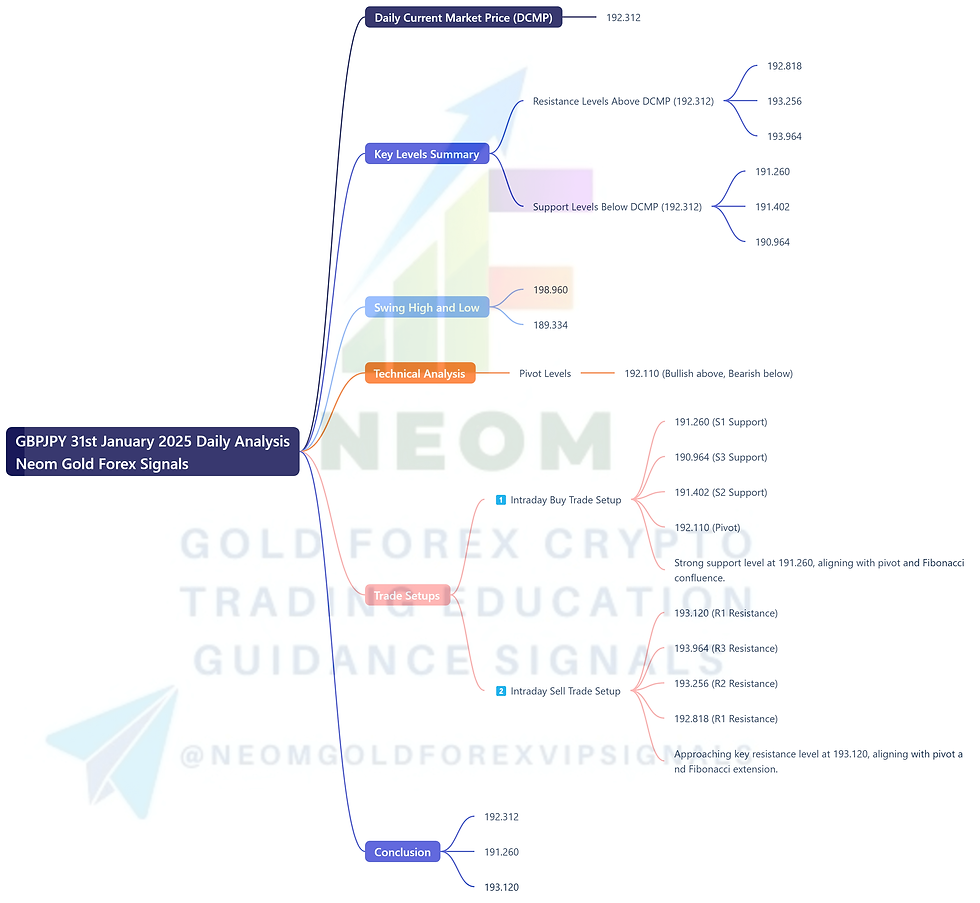

The Daily Current Market Price (DCMP) for GBPJPY is 192.312. Below this level, the market finds support, while above it, resistance dominates. Here’s a crisp and accurate analysis of key levels, swing highs/lows, and intraday trade setups based on technical and fundamental factors.

Key Levels Summary

Above DCMP (Resistance): 192.818 (R1), 193.256 (R2), 193.964 (R3)

Below DCMP (Support): 191.260 (S1), 191.402 (S2), 190.964 (S3)

Swing High: 198.960

Swing Low: 189.334

Technical Analysis

Pivot Levels: The pivot at 192.110 acts as a critical level. Above this, the bias is bullish; below, it’s bearish.

Fibonacci Levels: Key retracement levels align with support and resistance zones, providing confluence for trade setups.

RSI & MACD: RSI shows neutral momentum, while MACD hints at a potential crossover, indicating a shift in market sentiment.

Trade Setups

Intraday Buy Trade Setup

Entry Price: 🎯 191.260 (S1 Support)

Stop Loss: 🛑 190.964 (S3 Support)

Take Profit 1: 🎯 191.402 (S2 Support)

Take Profit 2: 🎯 192.110 (Pivot)

Rationale: The price is near a strong support level (191.260), aligning with the pivot and Fibonacci confluence. A bounce from this level offers a low-risk buying opportunity.

Intraday Sell Trade Setup

Entry Price: 🎯 193.120 (R1 Resistance)

Stop Loss: 🛑 193.964 (R3 Resistance)

Take Profit 1: 🎯 193.256 (R2 Resistance)

Take Profit 2: 🎯 192.818 (R1 Resistance)

Rationale: The price is approaching a key resistance level (193.120), which aligns with the pivot and Fibonacci extension. A rejection here presents a high-probability selling opportunity.

Conclusion

GBPJPY is currently trading at 192.312, with key support at 191.260 and resistance at 193.120. The market shows a balanced sentiment, but the pivot level at 192.110 will dictate the next directional move. Traders should watch for price action at these levels and consider the intraday buy and sell setups outlined above.

Comments