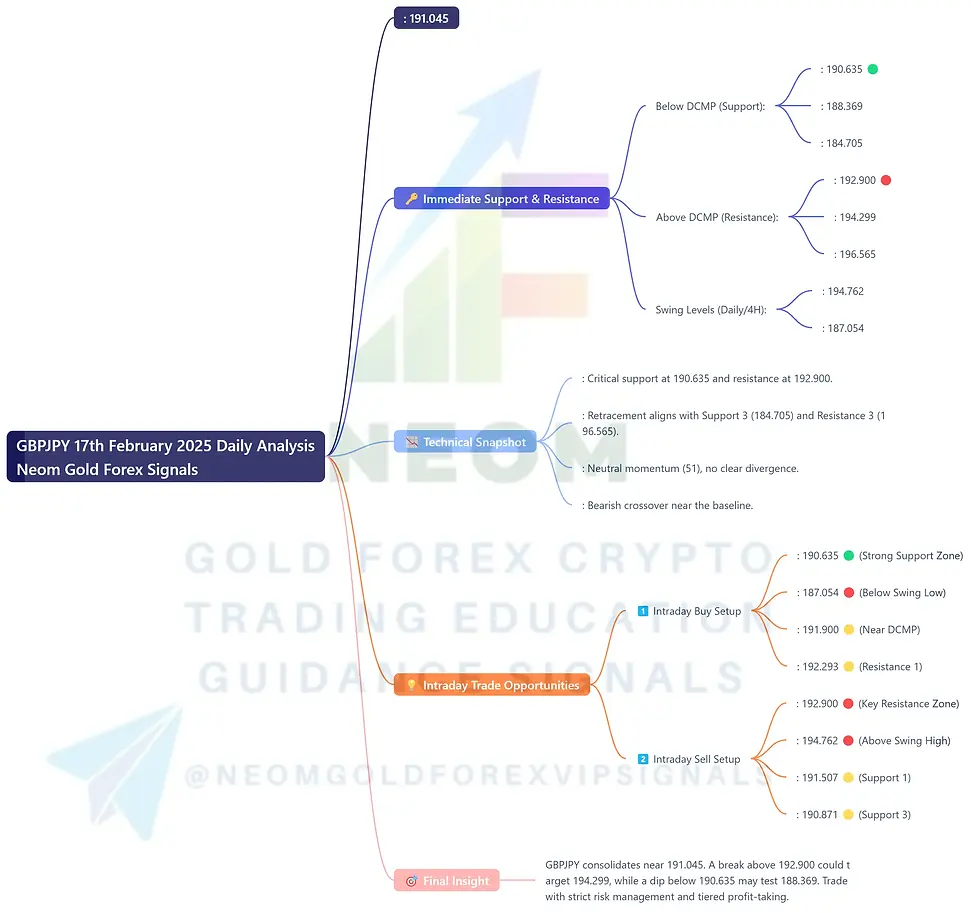

📊 GBPJPY 17th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 17

- 1 min read

Daily Current Market Price (DCMP): 191.045

🔑 Immediate Support & Resistance

Below DCMP (Support):

Support 1: 190.635 🟢 | Support 2: 188.369 | Support 3: 184.705

Above DCMP (Resistance):

Resistance 1: 192.900 🔴 | Resistance 2: 194.299 | Resistance 3: 196.565

Swing Levels (Daily/4H):

Swing High: 194.762 | Swing Low: 187.054

📉 Technical Snapshot

Key Zones: Critical support at 190.635 and resistance at 192.900.

Fibonacci Levels: Retracement aligns with Support 3 (184.705) and Resistance 3 (196.565).

RSI: Neutral momentum (51), no clear divergence.

MACD: Bearish crossover near the baseline.

💡 Intraday Trade Opportunities

1️⃣ Intraday Buy Setup

Entry: 190.635 🟢 (Strong Support Zone)

Stop Loss: 187.054 🔴 (Below Swing Low)

Take Profit 1: 191.900 🟡 (Near DCMP)

Take Profit 2: 192.293 🟡 (Resistance 1)

2️⃣ Intraday Sell Setup

Entry: 192.900 🔴 (Key Resistance Zone)

Stop Loss: 194.762 🔴 (Above Swing High)

Take Profit 1: 191.507 🟡 (Support 1)

Take Profit 2: 190.871 🟡 (Support 3)

🎯 Final Insight

GBPJPY consolidates near 191.045. A break above 192.900 could target 194.299, while a dip below 190.635 may test 188.369. Trade with strict risk management and tiered profit-taking.

Risk Note: Validate setups with live price action. Adjust dynamically to volatility. 🚨

Comments