💹 DXY Daily Analysis Based on Main Key Levels – March 24, 2025

- Neom

- Mar 24

- 1 min read

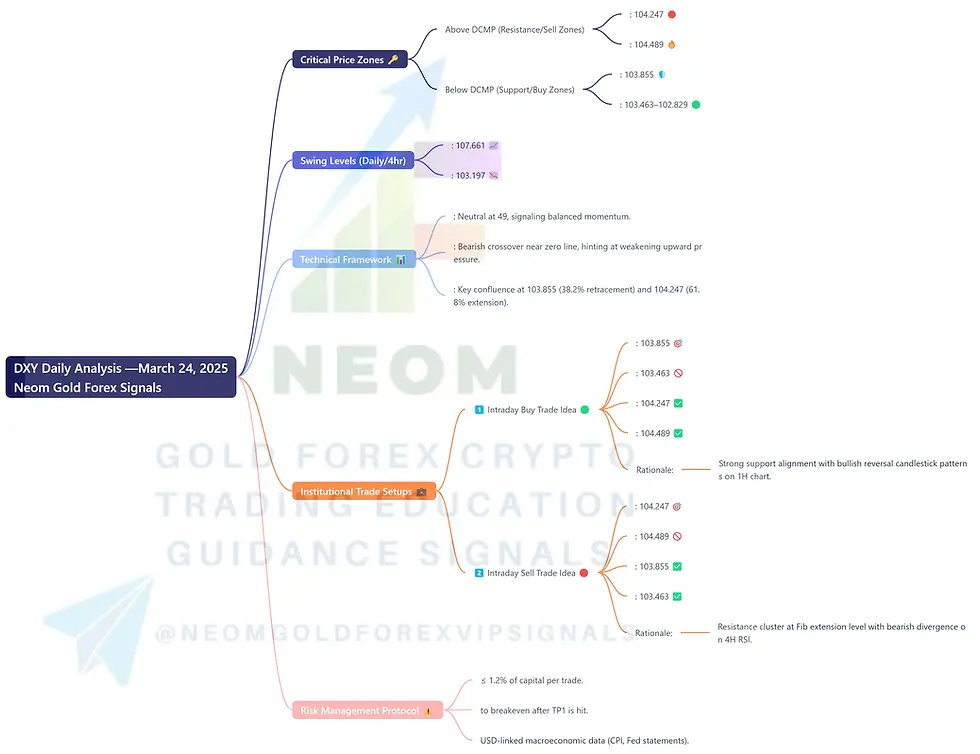

Daily Current Market Price (DCMP): 103.931

Critical Price Zones 🔑

Above DCMP (Resistance/Sell Zones):

Immediate Resistance: 104.247 🛑

Major Resistance: 104.489 🔥

Below DCMP (Support/Buy Zones):

Immediate Support: 103.855 🛡️

Major Support: 103.463–102.829 🟢

Swing Levels (Daily/4hr):

Swing High: 107.661 📈

Swing Low: 103.197 📉

Technical Framework 📊

RSI: Neutral at 49, signaling balanced momentum.

MACD: Bearish crossover near zero line, hinting at weakening upward pressure.

Fibonacci: Key confluence at 103.855 (38.2% retracement) and 104.247 (61.8% extension).

Institutional Trade Setups 💼

1️⃣ Intraday Buy Trade Idea 🟢

Entry: 103.855 🎯

Stop Loss: 103.463 🚫

Take Profit 1: 104.247 ✅

Take Profit 2: 104.489 ✅

Rationale: Strong support alignment with bullish reversal candlestick patterns on 1H chart.

2️⃣ Intraday Sell Trade Idea 🔴

Entry: 104.247 🎯

Stop Loss: 104.489 🚫

Take Profit 1: 103.855 ✅

Take Profit 2: 103.463 ✅

Rationale: Resistance cluster at Fib extension level with bearish divergence on 4H RSI.

Risk Management Protocol ⚠️

Position size ≤1.2% of capital per trade.

Adjust stops to breakeven after TP1 is hit.

Monitor USD-linked macroeconomic data (CPI, Fed statements).

This analysis combines Fibonacci retracements, institutional liquidity zones, and momentum indicators. Confirm with real-time order flow before execution. 🚨

Comments