📈 DXY 20th March 2025 Daily Analysis Based on Main Key Levels

- Neom

- Mar 20

- 1 min read

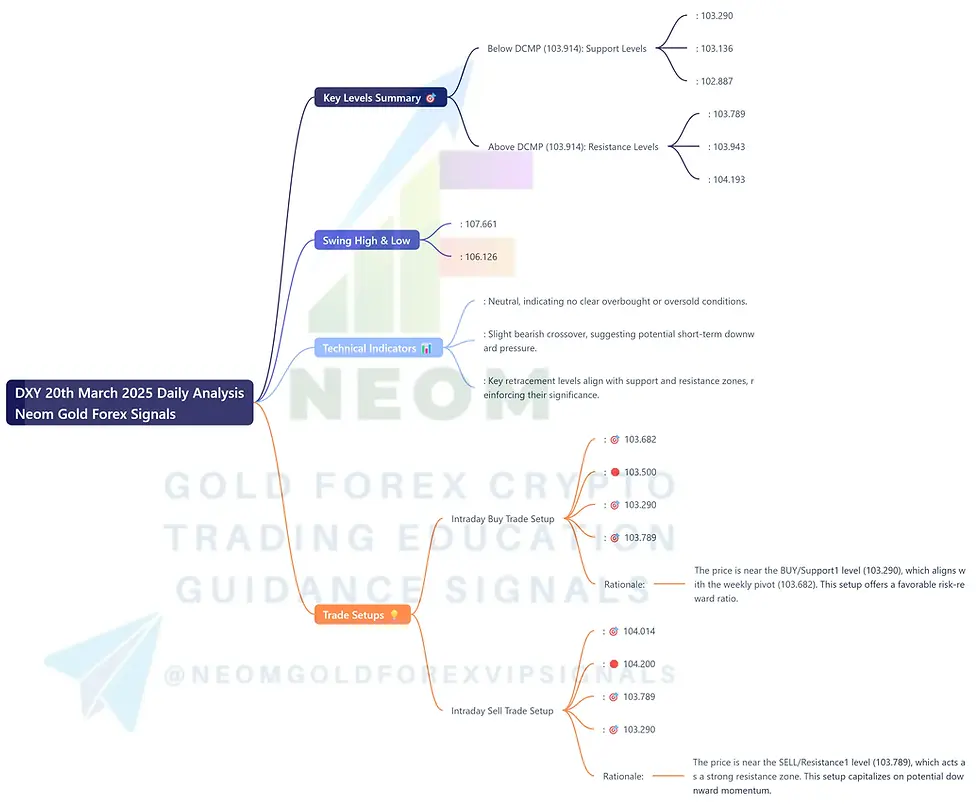

The Daily Current Market Price (DCMP) for DXY stands at 103.914. Below and above this level, we identify critical support and resistance zones that will guide our intraday trading strategy. Here’s a crisp and accurate analysis of the key levels and trade setups.

Key Levels Summary 🎯

Below DCMP (103.914): Support Levels

BUY/Support1: 103.290

BUY/Support2: 103.136

BUY/Support3: 102.887

Above DCMP (103.914): Resistance Levels

SELL/Resistance1: 103.789

SELL/Resistance2: 103.943

SELL/Resistance3: 104.193

Swing High & Low

Swing High (Daily): 107.661

Swing Low (Daily): 106.126

Technical Indicators 📊

RSI Divergence: Neutral, indicating no clear overbought or oversold conditions.

MACD Crossing: Slight bearish crossover, suggesting potential short-term downward pressure.

Fibonacci Levels: Key retracement levels align with support and resistance zones, reinforcing their significance.

Trade Setups 💡

Intraday Buy Trade Setup

Entry Price: 🎯 103.682

Stop Loss: 🛑 103.500

Take Profit 1: 🎯 103.290

Take Profit 2: 🎯 103.789

Rationale: The price is near the BUY/Support1 level (103.290), which aligns with the weekly pivot (103.682). This setup offers a favorable risk-reward ratio.

Intraday Sell Trade Setup

Entry Price: 🎯 104.014

Stop Loss: 🛑 104.200

Take Profit 1: 🎯 103.789

Take Profit 2: 🎯 103.290

Rationale: The price is near the SELL/Resistance1 level (103.789), which acts as a strong resistance zone. This setup capitalizes on potential downward momentum.

Conclusion 🏁

DXY’s current price action is consolidating around key levels, offering clear intraday trading opportunities. The Intraday Buy setup at 103.682 and the Intraday Sell setup at 104.014 are both well-defined with tight stop losses and achievable take profit targets. Always monitor price action and adjust strategies accordingly.

Comments