💵 DXY 10th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 10

- 1 min read

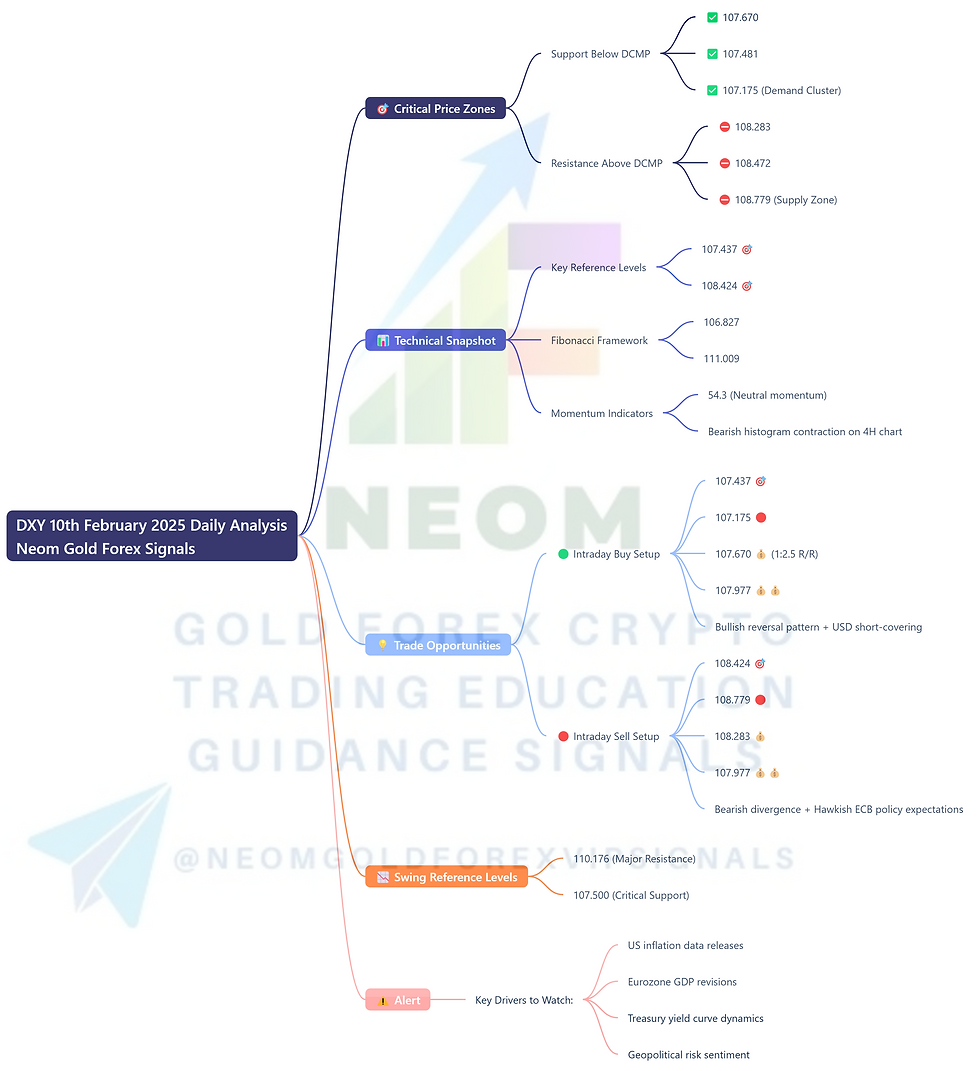

Daily Current Market Price (DCMP): 108.211

🎯 Critical Price Zones

Support Below DCMP:

✅ 107.670 | 107.481 | 107.175 (Demand Cluster)

Resistance Above DCMP:

⛔️ 108.283 | 108.472 | 108.779 (Supply Zone)

📊 Technical Snapshot

Key Reference Levels:

Immediate Floor: 107.437 🎯

Ceiling Threshold: 108.424 🎯

Fibonacci Framework:

38.2% Retracement: 106.827

161.8% Extension: 111.009

Momentum Indicators:

RSI: 54.3 (Neutral momentum)

MACD: Bearish histogram contraction on 4H chart

💡 Trade Opportunities

🟢 Intraday Buy Setup

Entry: 107.437 🎯

Stop Loss: 107.175 🔴

Take Profit 1: 107.670 💰 (1:2.5 R/R)

Take Profit 2: 107.977 💰💰

Catalyst: Bullish reversal pattern + USD short-covering

🔴 Intraday Sell Setup

Entry: 108.424 🎯

Stop Loss: 108.779 🔴

Take Profit 1: 108.283 💰

Take Profit 2: 107.977 💰💰

Trigger: Bearish divergence + Hawkish ECB policy expectations

📉 Swing Reference Levels

Swing High: 110.176 (Major Resistance)

Swing Low: 107.500 (Critical Support)

💬 Market Pulse

DXY consolidates near 108.211 as Fed rate cut bets clash with safe-haven demand. Bulls need break above 108.424 to target 108.779, while bears target 107.437 support. Monitor US CPI data and EUR/USD volatility.

⚠️ Alert: Maintain tight stops – FX markets face event risk from Fed Chair Powell's testimony.

Key Drivers to Watch:

US inflation data releases

Eurozone GDP revisions

Treasury yield curve dynamics

Geopolitical risk sentiment

Comments