🟡 BTCUSD Daily Market Analysis—June 19, 2025

- Neom

- Jun 19, 2025

- 3 min read

Introduction

In the ever-evolving cryptocurrency market, Bitcoin (BTC) continues to capture the attention of traders and investors alike. As of today, the BTCUSD live price stands at $104,988. This analysis provides a detailed examination of the daily and 4-hour time frames using various technical indicators, including Fibonacci Retracement Levels, Exponential Moving Averages (EMA), RSI divergence, support and resistance levels, order blocks, and MACD. Additionally, we will highlight key upcoming USD news that may impact the BTCUSD market. 🚀

Market Overview

Current Market Price

BTCUSD Live Price: $104,988 💰

Key Swing Levels

Swing High: $110,587 📈

Swing Low: $103,388 📉

Technical Analysis

Support & Resistance Levels

Daily Time Frame

Support Levels:

S1: $103,388 (Swing Low) 🔻

S2: $102,500

S3: $101,000

Resistance Levels:

R1: $105,500 🔺

R2: $107,000

R3: $110,000

4-Hour Time Frame

Support Levels:

S1: $103,800 🔻

S2: $103,000

S3: $102,200

Resistance Levels:

R1: $105,200 🔺

R2: $106,000

R3: $107,500

Fibonacci Retracement Levels

Using the recent swing high and low, we can identify key Fibonacci levels:

23.6% Level: $105,200

38.2% Level: $104,500

61.8% Level: $103,800

These levels act as potential reversal points, and traders often use them to identify entry and exit points. 🎯

Exponential Moving Averages (EMA)

Daily Time Frame

EMA 50: $104,800

EMA 100: $104,300

EMA 200: $103,500

EMA 400: $102,000

4-Hour Time Frame

EMA 50: $104,600

EMA 100: $104,200

EMA 200: $103,800

EMA 400: $102,500

The EMAs provide insights into the overall trend direction. Currently, the price is above the 50 EMA on both time frames, indicating a bullish sentiment. 📈

RSI Divergence

The Relative Strength Index (RSI) is currently showing a divergence on the 4-hour time frame. While the price is making higher highs, the RSI is making lower highs, suggesting potential weakness in the bullish momentum. Traders should watch for a possible correction if this divergence continues. ⚠️

Order Blocks

Order blocks are significant price levels where large orders have been placed. In the current market, we can identify a bullish order block around the $103,800 level, which aligns with the 61.8% Fibonacci retracement. This area may serve as a strong support zone. 🛑

MACD Analysis

The Moving Average Convergence Divergence (MACD) indicator is currently showing a bullish crossover on the daily time frame, indicating potential upward momentum. However, caution is advised as the histogram is approaching zero, suggesting a possible weakening trend. 📉

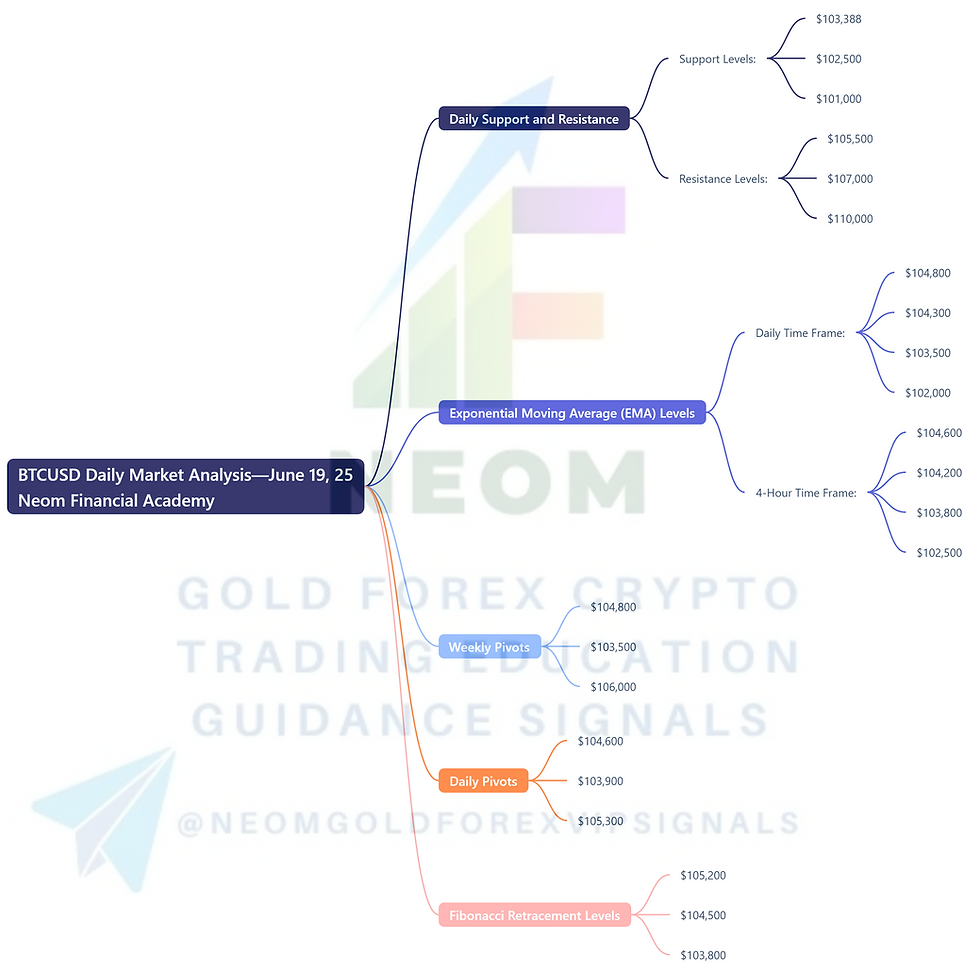

Summary of Key Levels

Daily Support and Resistance

Support Levels: $103,388, $102,500, $101,000 🔻

Resistance Levels: $105,500, $107,000, $110,000 🔺

Exponential Moving Average (EMA) Levels

Daily Time Frame:

EMA 50: $104,800

EMA 100: $104,300

EMA 200: $103,500

EMA 400: $102,000

4-Hour Time Frame:

EMA 50: $104,600

EMA 100: $104,200

EMA 200: $103,800

EMA 400: $102,500

Weekly Pivots

Pivot Point: $104,800

Support: $103,500

Resistance: $106,000

Daily Pivots

Pivot Point: $104,600

Support: $103,900

Resistance: $105,300

Fibonacci Retracement Levels

23.6% Level: $105,200

38.2% Level: $104,500

61.8% Level: $103,800

Fundamental Analysis and Upcoming USD News

As we look ahead, several key economic events are scheduled that could significantly impact the BTCUSD market:

Federal Reserve Interest Rate Decision: The Federal Reserve is set to announce its interest rate decision next week. A change in rates can influence investor sentiment in cryptocurrencies, including Bitcoin. 🏦

Inflation Data Release: Upcoming inflation reports may also sway market dynamics. Higher inflation could lead to increased interest in Bitcoin as a hedge against currency devaluation. 📊

Employment Data: The monthly employment report is expected soon, providing insights into the health of the U.S. economy. Strong employment figures may bolster the USD, potentially affecting Bitcoin's price. 📅

Traders should stay informed about these events, as they can lead to increased volatility in the BTCUSD market.

Conclusion

In summary, the BTCUSD market presents a complex landscape influenced by various technical indicators and fundamental factors. The current price of $104,988 sits within a critical range, with several support and resistance levels identified on both daily and 4-hour time frames. As we watch the market evolve, staying attuned to upcoming USD news will be essential for making informed trading decisions. 🔍

Comments