🟡 BTCUSD Daily Market Analysis – January 21, 2026

- Neom

- Jan 21

- 3 min read

Introduction

In this detailed market analysis, we examine the current state of the BTCUSD market, with Bitcoin trading at 89,382 USD. Utilizing various technical indicators such as Fibonacci Retracement Levels, Exponential Moving Averages (EMA), RSI divergence, and more, we will provide insights for both daily and 4-hour timeframes. Our goal is to equip traders with the necessary tools to make informed decisions in this dynamic market.

Market Overview

Bitcoin, as the leading cryptocurrency, remains a focal point for traders and investors. Its price movements are influenced by various factors, including market sentiment, news events, and technical indicators. In this analysis, we will highlight key support and resistance levels, EMA values, and other critical indicators that can guide trading strategies.

Current Market Price

Bitcoin (BTCUSD): 89,382 USD

Technical Analysis

Support & Resistance Levels

Daily Timeframe:

Support Levels:

First Support: 88,500 USD

Second Support: 87,500 USD

Third Support: 86,000 USD

Resistance Levels:

First Resistance: 90,000 USD

Second Resistance: 91,500 USD

Third Resistance: 92,500 USD

4-Hour Timeframe:

Support Levels:

First Support: 88,500 USD

Second Support: 87,500 USD

Third Support: 86,000 USD

Resistance Levels:

First Resistance: 90,000 USD

Second Resistance: 91,500 USD

Third Resistance: 92,500 USD

Fibonacci Retracement Levels

Using the swing high of 97,942 USD and swing low of 89,974 USD, the Fibonacci retracement levels are as follows:

23.6%: 90,500 USD

38.2%: 91,200 USD

50%: 92,000 USD

61.8%: 92,800 USD

These levels indicate potential reversal points where traders may consider entering or exiting positions.

Exponential Moving Averages (EMA)

Daily Timeframe:

EMA 50: 90,000 USD

EMA 100: 89,500 USD

EMA 200: 88,800 USD

EMA 400: 88,200 USD

4-Hour Timeframe:

EMA 50: 89,800 USD

EMA 100: 89,300 USD

EMA 200: 88,900 USD

EMA 400: 88,400 USD

The EMAs provide insights into the overall trend direction. Currently, the price is fluctuating around the EMAs on the daily timeframe, indicating a consolidation phase.

RSI Divergence

The Relative Strength Index (RSI) is currently showing signs of divergence. While the price of Bitcoin has been rising, the RSI has not confirmed this upward movement, suggesting potential weakness in the current bullish momentum. Traders should monitor this closely, as it could indicate a reversal or correction.

Order Blocks

Order blocks are significant areas where institutional traders have placed large orders. In the current analysis, we identify the following order blocks:

Bullish Order Block: 88,000 USD to 88,500 USD

Bearish Order Block: 90,500 USD to 91,000 USD

These zones are critical for understanding potential price reactions.

MACD Analysis

The Moving Average Convergence Divergence (MACD) indicator is currently showing a bearish crossover, suggesting potential downward momentum. However, traders should be cautious, as the MACD histogram is beginning to flatten, indicating that the downward momentum may be losing strength.

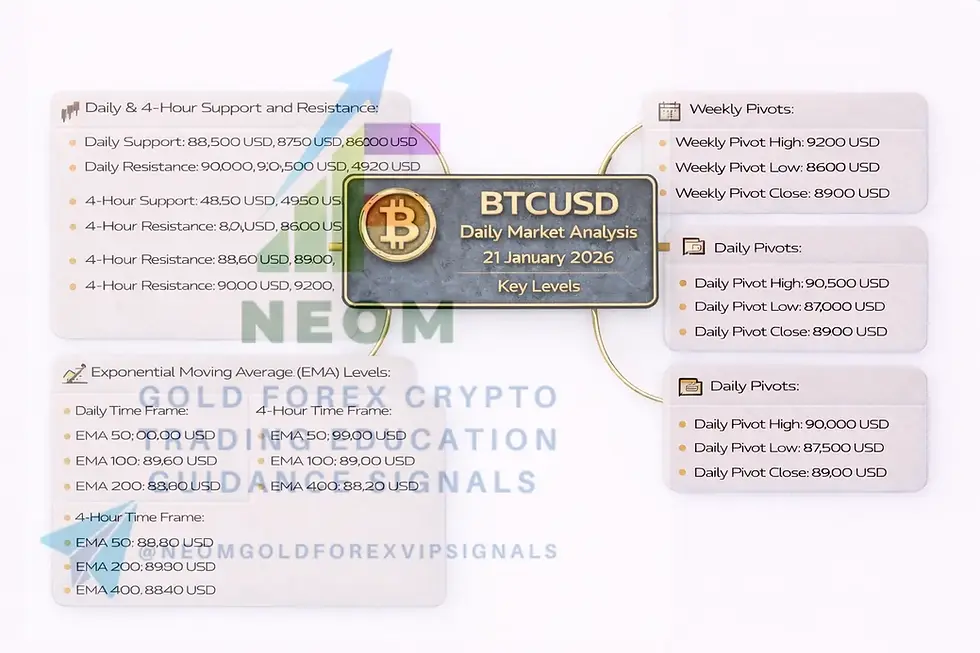

Summary of Key Levels

Daily & 4-Hour Support and Resistance

Daily Support: 88,500 USD, 87,500 USD, 86,000 USD

Daily Resistance: 90,000 USD, 91,500 USD, 92,500 USD

4-Hour Support: 88,500 USD, 87,500 USD, 86,000 USD

4-Hour Resistance: 90,000 USD, 91,500 USD, 92,500 USD

Exponential Moving Average (EMA) Levels

Daily Time Frame:

EMA 50: 90,000 USD

EMA 100: 89,500 USD

EMA 200: 88,800 USD

EMA 400: 88,200 USD

4-Hour Time Frame:

EMA 50: 89,800 USD

EMA 100: 89,300 USD

EMA 200: 88,900 USD

EMA 400: 88,400 USD

Weekly Pivots

Weekly Pivot High: 92,500 USD

Weekly Pivot Low: 86,000 USD

Weekly Pivot Close: 89,000 USD

Daily Pivots

Daily Pivot High: 90,000 USD

Daily Pivot Low: 87,500 USD

Daily Pivot Close: 89,000 USD

Conclusion

In summary, the BTCUSD market presents a complex landscape influenced by various technical indicators. Traders should pay close attention to the identified support and resistance levels, Fibonacci retracement levels, and the behavior of the EMA and RSI. The current market shows signs of consolidation, and caution is advised due to potential divergence and weakness in momentum.

Comments