🏦 BankNifty-NSE INDEX 6th March 2025 Daily Analysis: Critical Technical Thresholds

- Neom

- Mar 6

- 2 min read

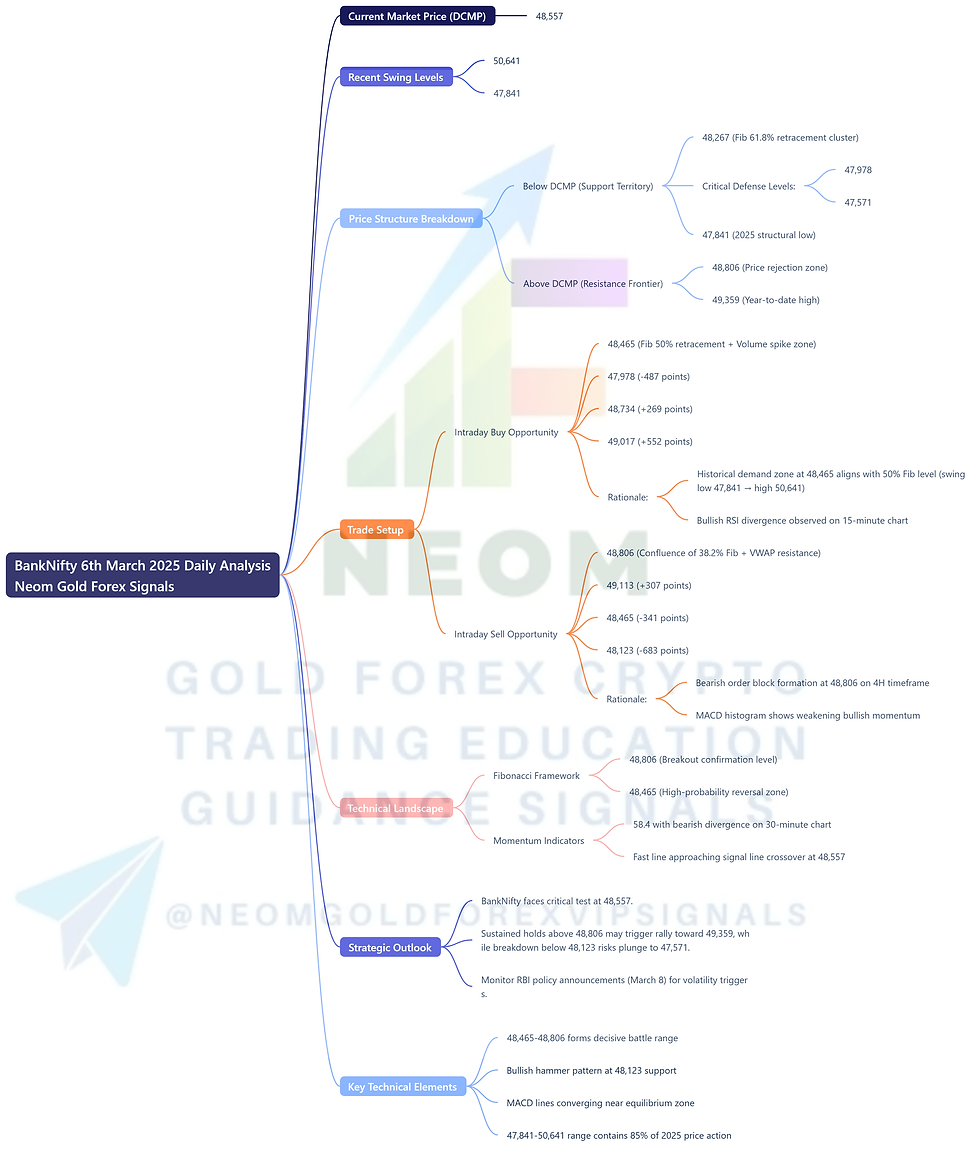

Current Market Price (DCMP): 48,557

Recent Swing High: 50,641 | Recent Swing Low: 47,841

🔥 Price Structure Breakdown

🔻 Below DCMP (Support Territory)

Immediate Floor: 48,267 (Fib 61.8% retracement cluster)

Critical Defense: 47,978 | 47,571

Breakdown Catalyst: 47,841 (2025 structural low)

🔺 Above DCMP (Resistance Frontier)

First Barrier: 48,806 (Price rejection zone)

Upper Limit: 49,359 (Year-to-date high)

🚨 Trade Setup

🟢 Intraday Buy Opportunity

Entry: 🎯 48,465 (Fib 50% retracement + Volume spike zone)

Stop Loss: 🔴 47,978 (-487 points)

Take Profit 1: 🚀 48,734 (+269 points)

Take Profit 2: 💥 49,017 (+552 points)

Rationale:

Historical demand zone at 48,465 aligns with 50% Fib level (swing low 47,841 → high 50,641)

Bullish RSI divergence observed on 15-minute chart

🔴 Intraday Sell Opportunity

Entry: 🎯 48,806 (Confluence of 38.2% Fib + VWAP resistance)

Stop Loss: 🔴 49,113 (+307 points)

Take Profit 1: 🚀 48,465 (-341 points)

Take Profit 2: 💥 48,123 (-683 points)

Rationale:

Bearish order block formation at 48,806 on 4H timeframe

MACD histogram shows weakening bullish momentum

📉 Technical Landscape

Fibonacci Framework

38.2% Resistance: 48,806 (Breakout confirmation level)

50% Support: 48,465 (High-probability reversal zone)

Momentum Indicators

RSI: 58.4 with bearish divergence on 30-minute chart

MACD: Fast line approaching signal line crossover at 48,557

🎯 Strategic Outlook

BankNifty faces critical test at 48,557. Sustained holds above 48,806 may trigger rally toward 49,359, while breakdown below 48,123 risks plunge to 47,571. Monitor RBI policy announcements (March 8) for volatility triggers.

⚡ Catalyst Watch: US NFP data release (March 7) – strong numbers could amplify global risk-off sentiment!

Key Technical Elements:

48,465-48,806 forms decisive battle range

Bullish hammer pattern at 48,123 support

MACD lines converging near equilibrium zone

47,841-50,641 range contains 85% of 2025 price action

⚠️ Risk Notice: Index derivatives carry elevated volatility. Use 2% capital allocation per trade with trailing stops.

Comments