🎯 BankNifty-NSE INDEX 20th February 2025 Daily Analysis Based on Key Levels

- Neom

- Feb 20

- 1 min read

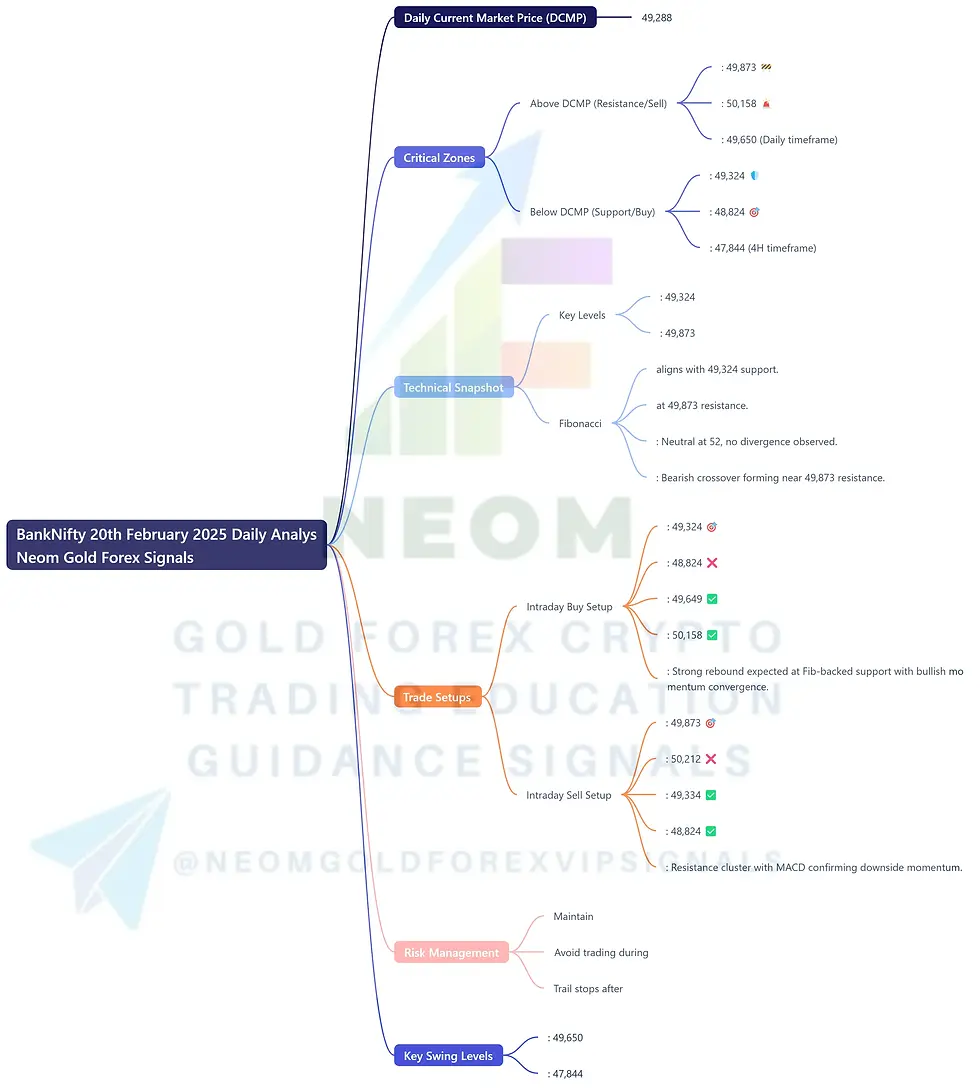

Daily Current Market Price (DCMP): 49,288

🔑 Critical Zones

Above DCMP (Resistance/Sell):

Immediate Resistance: 49,873 🚧

Strong Resistance: 50,158 🚨

Swing High: 49,650 (Daily timeframe)

Below DCMP (Support/Buy):

Immediate Support: 49,324 🛡️

Strong Support: 48,824 🎯

Swing Low: 47,844 (4H timeframe)

📊 Technical Snapshot

Key Levels:

Buy Zone: 49,324 | Sell Zone: 49,873

Fibonacci:

61.8% retracement aligns with 49,324 support.

38.2% extension at 49,873 resistance.

RSI: Neutral at 52, no divergence observed.

MACD: Bearish crossover forming near 49,873 resistance.

💼 Trade Setups

🟢 Intraday Buy Setup

Entry: 49,324 🎯

Stop Loss: 48,824 ❌

Take Profit 1: 49,649 ✅

Take Profit 2: 50,158 ✅

Rationale: Strong rebound expected at Fib-backed support with bullish momentum convergence.

🔴 Intraday Sell Setup

Entry: 49,873 🎯

Stop Loss: 50,212 ❌

Take Profit 1: 49,334 ✅

Take Profit 2: 48,824 ✅

Rationale: Resistance cluster with MACD confirming downside momentum.

⚠️ Risk Management

Maintain 1:2.5 risk-reward ratio.

Avoid trading during high-impact economic data releases.

Trail stops after TP1 hit.

Key Swing Levels: High at 49,650 | Low at 47,844

🔍 Analysis integrates price action, Fibonacci retracements, and momentum indicators for tactical execution.

Comments