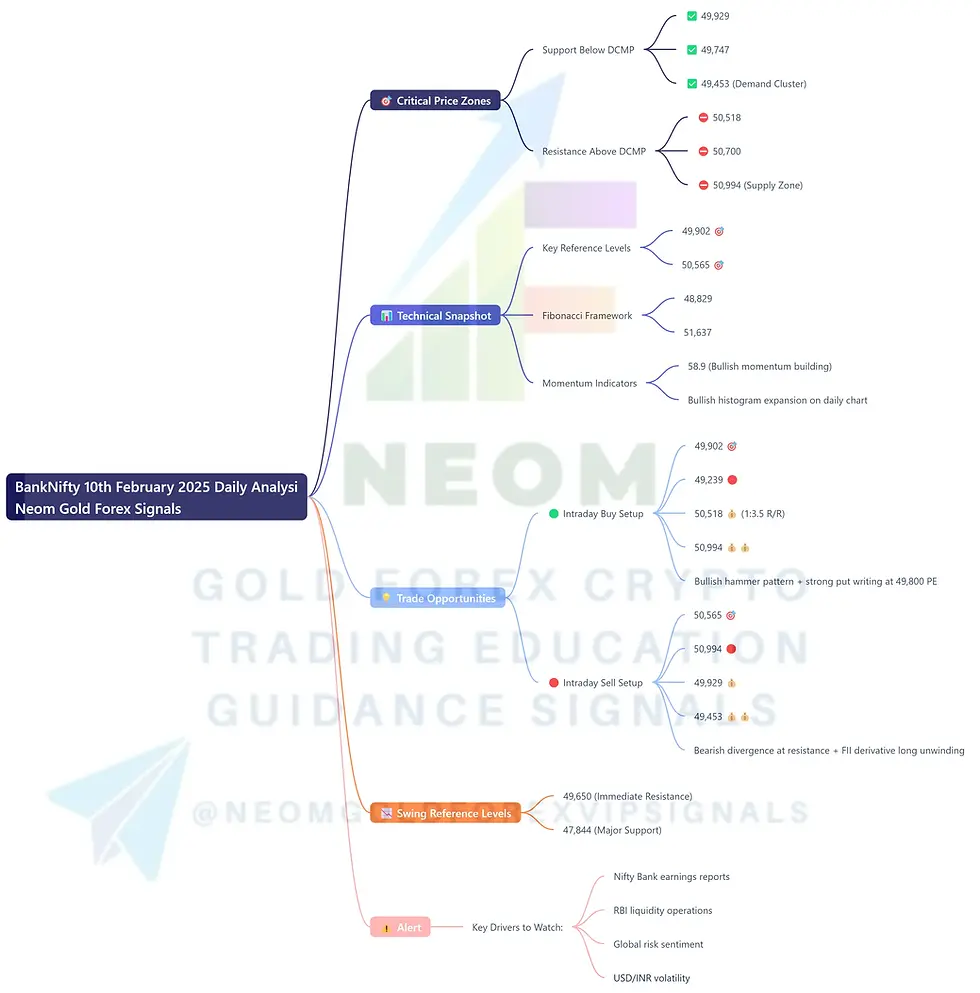

📈 BankNifty-NSE INDEX 10th February 2025 Daily Analysis Based on Main Key Levels

- Neom

- Feb 10

- 1 min read

Daily Current Market Price (DCMP): 49,981

🎯 Critical Price Zones

Support Below DCMP:

✅ 49,929 | 49,747 | 49,453 (Demand Cluster)

Resistance Above DCMP:

⛔️ 50,518 | 50,700 | 50,994 (Supply Zone)

📊 Technical Snapshot

Key Reference Levels:

Immediate Floor: 49,902 🎯

Ceiling Threshold: 50,565 🎯

Fibonacci Framework:

38.2% Retracement: 48,829

161.8% Extension: 51,637

Momentum Indicators:

RSI: 58.9 (Bullish momentum building)

MACD: Bullish histogram expansion on daily chart

💡 Trade Opportunities

🟢 Intraday Buy Setup

Entry: 49,902 🎯

Stop Loss: 49,239 🔴

Take Profit 1: 50,518 💰 (1:3.5 R/R)

Take Profit 2: 50,994 💰💰

Catalyst: Bullish hammer pattern + strong put writing at 49,800 PE

🔴 Intraday Sell Setup

Entry: 50,565 🎯

Stop Loss: 50,994 🔴

Take Profit 1: 49,929 💰

Take Profit 2: 49,453 💰💰

Trigger: Bearish divergence at resistance + FII derivative long unwinding

📉 Swing Reference Levels

Swing High: 49,650 (Immediate Resistance)

Swing Low: 47,844 (Major Support)

💬 Market Pulse

BankNifty consolidates near 49,981 amid mixed FII/DII activity. Bulls need sustained move above 50,565 to target 50,994, while bears aim for 49,902 support. Monitor RBI policy outcomes and US bond yield movements.

⚠️ Alert: Maintain 1:3 risk-reward ratio ahead of monthly expiry. Price action likely volatile with key resistance at 50,565.

Key Drivers to Watch:

Nifty Bank earnings reports

RBI liquidity operations

Global risk sentiment

USD/INR volatility

Comments